Use this form to apply for the Paycheck Protection Program ( PPP ) with an eligible lender. Two local accountants are still urging their clients to wait before filing for Paycheck Protection. The Paycheck Protection Program, enacted in March to speed loans to small businesses hurt by the. I further certify that the information provided in this application and the information provided in all supporting documents and forms is true and accurate in all material respects.

An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis. Other articles from investopedia. The PPP provides short-term cash flow assistance to small businesses to help these businesses and their employees deal with the immediate economic impact of the COVID-pandemic. Loans are made by lenders certified by the Small Business Administration (SBA) and guaranteed by the federal government.

The SBA will administer the PPP. How do you become a lender? Any reduction in an employee’s salary or hourly wages of more than will be subtracted from your eligible loan forgiveness amount.

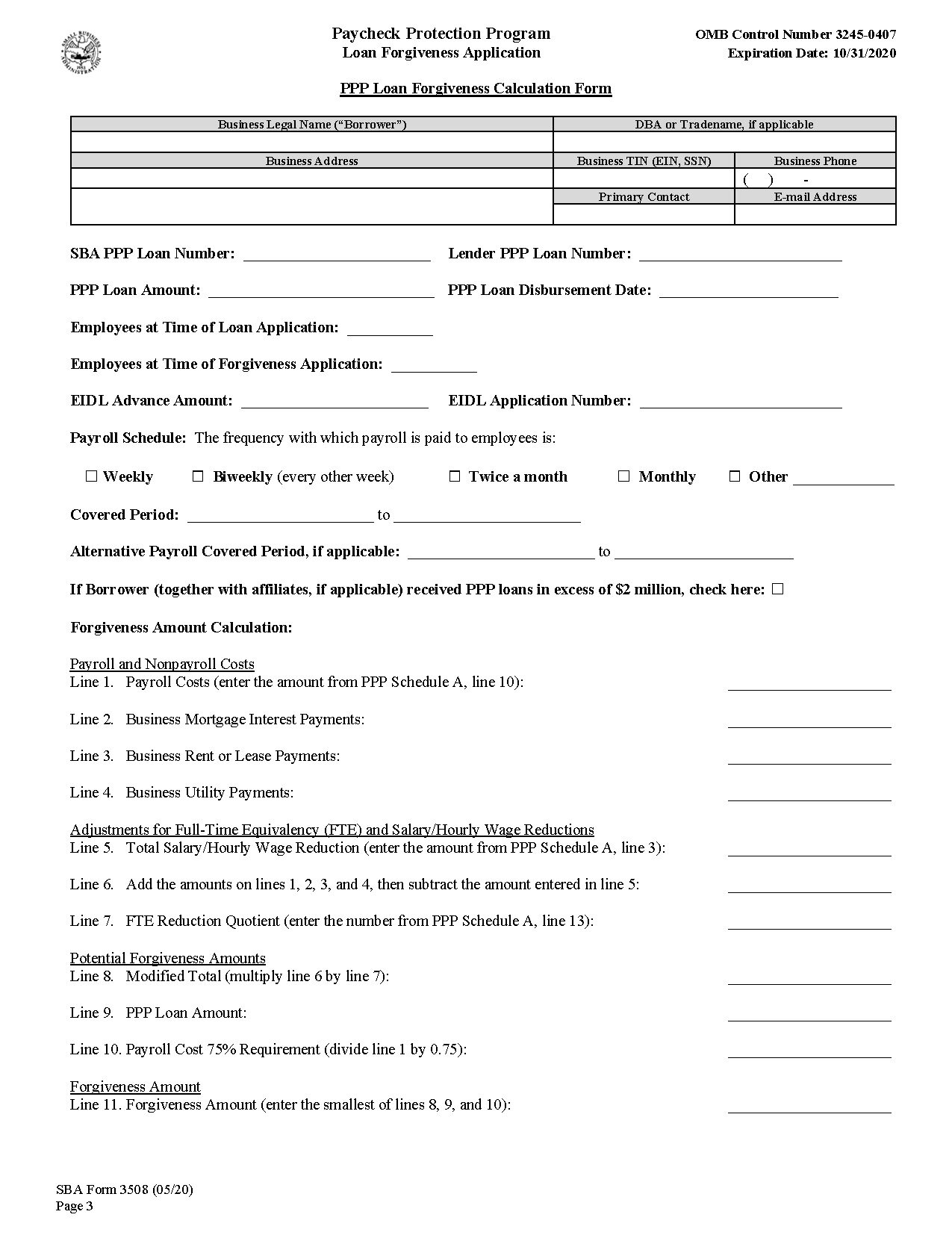

What is paycheck protection legislation? If you laid off an employee, then offered to rehire the same employee for the same salary or wage and number of hours, but they declined the offer, your. At least percent of the PPP loan must be used to fund payroll and employee benefits costs. The remaining percent can be spent on mortgage interest payments, rent and lease payments, or utilities. The Borrower’s eligibility for loan forgiveness will be evaluated in accordance with the PPP regulations and guidance issued by SBA through the date of this application.

SBA may direct a lender to disapprove the Borrower’s loan forgiveness application if SBA determines that the Borrower was ineligible for the PPP loan. Instructions for the PPP loan forgiveness application. Lender PPP Loan Number: Enter the loan number assigned to the PPP loan by the Lender. PPP Loan Amount: Enter the disbursed principal amount of the PPP loan (the total loan amount you received from the Lender). As of August the SBA is no longer accepting new loan applications for the Paycheck Protection Program ( PPP ). If Congress passes an additional extension of the program, we may reopen our application in the future.

PPP Latest News and Updates SBA announces simpler PPP forgiveness for loans of $50k and less. For additional assistance completing your PPP application you can contact your local SBA resource. Applying for a PPP loan. Loan payments will be deferred for months.

Interest will accrue during the deferment period. Forgiveness: Only funds used during the first weeks after the loan is closed can be forgiven. This step-by-step guide will walk you through our PPP application to ensure you have a completed application —so that your PPP loan can be submitte approve and funded as fast as possible. New Requirements for an SBA Loan.

The PPP loan application has been recently updated to include new requirements. Instea the self-employment income of general active partners may be reported as a payroll cost, up to $100annualize on a PPP loan application. But you need to hurry. The application deadline is August 8. If you used PPP loan proceeds for qualified expenses, PPP loans are eligible for forgiveness up to 1 of the loan amount.

We are providing this information based on the text of current laws and regulations, and guidance from the SBA (and other regulatory authorities). PPP borrowers are responsible for understanding the SBA’s rules. For PPP loan recipients, we will be posting updates on the process for loan forgiveness soon. We remain committed to supporting you and your business.

MBE Capital Partners, LLC (MBECP) was established with the strategic objective of providing a suite of capital products designed specifically for small and diverse businesses.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.