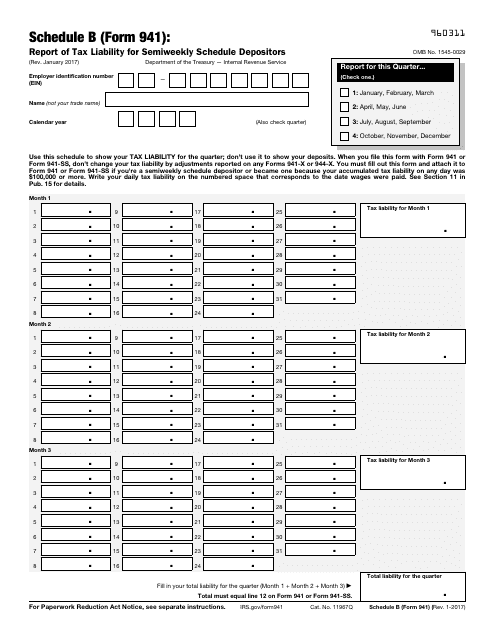

Write your daily tax liability on the numbered space that corresponds to the date wages were paid. Schedule B is filed with Form 941. It is used by those who are semi-weekly schedule depositors who report more than $50in employment taxes or if they acquired more than $100in liabilities during a single day in the tax year.

Form 9(or Form 9-SS) if you are a semiweekly schedule depositor or became one because your accumulated tax liability on any day was $100or more. What is the purpose of IRS 9form? What type of tax is reported on Form 941? About Publication 1(Circular PR), Federal Tax Guide for Employers in Puerto Rico.

Register and subscribe day free trial to work on your state specific tax form s online. See full list on apps. Write A Form 9With Our Automated Form Builder. Get Reliable Legal Form s Online.

Hundreds Of Templates At Your Fingertips. If your total payroll tax amounts are $50or more or if you had a tax liability of $100or more this year or the year before—you are a semi-weekly depositor. Every quarter your employer may need to complete a Form 9for the Internal Revenue Service (IRS).

The Form 9is used to report federal payroll tax liability. It outlines all the withheld income taxes, including tips, wages, paid sick leave and unemployment benefits. Updated on July 10:AM by Admin, TaxBandits. If you are an employer, you are responsible for withholding federal income taxes, social security taxes, and Medicare taxes from each of your employee’s wages. The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks.

The 9form reports the total amount of tax withheld during each quarter. B schedule forms printable. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

Start a free trial now to save yourself time and money! Users are seeing under days. Growing Thicker Stronger Hair Fast. Enter business info (Name and EIN)2. Select the quarter you’re filing for4.

Only the tax liability for each day is listed including the federal income tax, social security, social security employer, Medicare, and Medicare employer taxes. IRS Form 9- Mailing Address. Your Form 9mailing address depends on the state in which your business operates and whether you include payment with Form 9or not. List of domain same IP 5. Should I file Form 9, 94 or 943?

The Internal Revenue Service (IRS) will notify you which form you should. Customize Your Template Instantly. Form 9is a quarterly report of wages paid to employees and withholdings made by employers. This designation applies if you: Reported more than $50of employment taxes in the lookback period. Try the following solutions to troubleshoot and correct the diagnostic message on Form 9in Accounting CS.

Clear Form overrides. You were a monthly schedule depositor for the entire quarter.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.