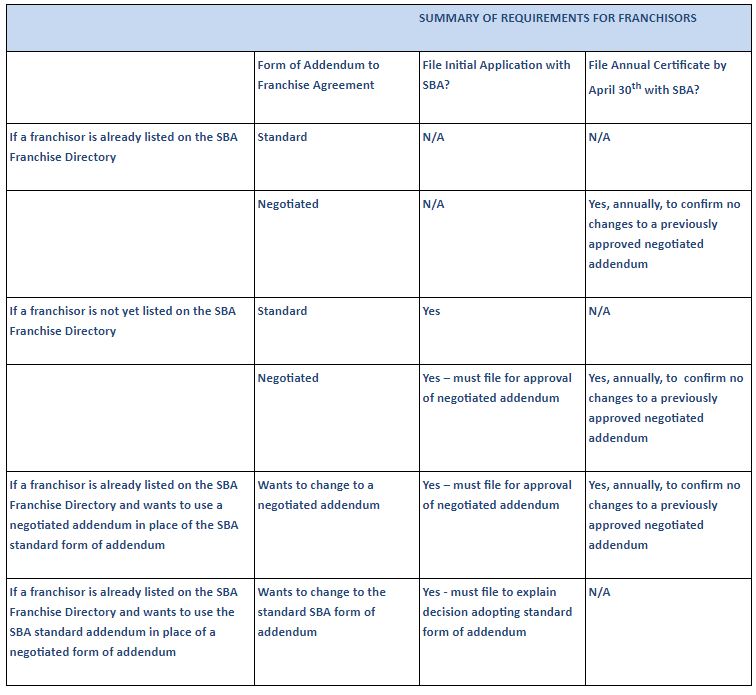

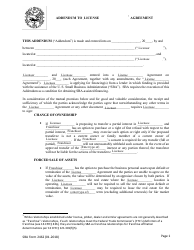

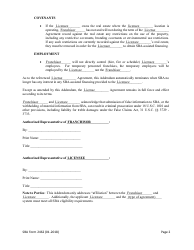

A franchisor and franchisee must use this form when a franchisee applies for SBA -assisted financing. Franchise Agreement”). Small Business Administration (“SBA”). SBA requires the execution of this Addendum as a condition for obtaining the SBA-assisted financing. The information provided in the form is used to ensure that no terms of the franchise agreements are enforced against the franchisee during the life of the SBA-guaranteed loan.

When the real estate where the franchise business is located will secure the SBA-guaranteed loan, the Addendum to Lease and Conditional Assignment of Lease may not be executed. Does buying an existing franchise qualify for a SBA loan? What does a franchise fee mean in a franchise agreement? What is a standard franchise agreement?

Any additional issues a lender should consider in reviewing loan applications from franchisees of the franchise brand. Under the SBA ’s new program, franchisors and franchisees are required to sign a new SBA Standard Addendum to the franchise agreement that covers affiliation between the franchisor and franchisee. Once the SBA Standard Addendum is signe the SBA will consider the franchisor and franchisee to be independent parties. Request more information on franchise opportunity for free.

Search franchise by location, category, capital requirement and more! The SBA will no longer review franchise agreements, instead requiring franchisors and franchisees to sign its non-negotiable, standard addendum for government-guaranteed lending. This clearly will cause significant confusion with franchisors, franchisees and lenders.

Instea it would require use of a standard two-page form franchise agreement addendum that a franchisor could use. This second option is only a temporary option and SBA has not given any guidance as to how long this option will be permitted. All other franchisors must use the standard SBA addendum.

SBA -backed loans have long been an important source of funding for many franchisees, but in the past several years, the system has been in flux. Changes will again be implemented on Jan. Please contact us with any questions.

This will no longer be allowe even though many in the franchise community encouraged SBA to at least grandfather in the existing negotiated SBA addendums. Now all franchisors, whether or not they have had affiliation issues in their documents and negotiated solutions, will be required to sign the standardized addendum for each franchisee SBA loan. The most popular is the SBA (a) loan, which can be used for a wide variety of purposes, including buying an existing business and opening a franchise.

While there are many reasons to consider an SBA loan, they are often misunderstood as either complex, difficult to obtain, or slow to process. For the lender’s part, the fact that the borrower is part of a franchise must be identified on SBA’s systems an if so, the lender must secure the signed two-page addendum. In my opinion, this seems like a pretty low bar to clear in order to secure a loan guarantee backed by the full faith and credit of the US government. The new form of SBA addendum is a binding addendum to the franchise agreement.

It remains in effect until the loan is paid in full or the SBA no longer has any interest in the loan. Browse for the business opportunity for you. The new addendum specifically states that it (the addendum itself) overrides any conflicts that may exist with the franchise agreement.

The SBA did a fine job in reducing the ambiguity in the process by making it clear that this new addendum will override any conflicts to the franchise agreement that do not meet SBA eligibility requirements,” said Tom Spadea, a partner with Spadea Lignana, a national franchise law firm. We note that this element of the CARES Act does not specify whether businesses can have 5or fewer employees per physical location and be eligible for the waiver like the general eligibility requirements state. When the small business applicant is a franchisor, SBA will review the franchise documentation and determine whether affiliation exists. Can the owner of a business for sale get pre-qualified for an SBA loan? For each listed franchise system, the SBA.

The mandatory addendum will make several changes to franchise agreements, such as: Narrowing the limits imposed on a franchisor’s right of first refusal in the case of a partial transfer. These brands recognize the importance of SBA lending to facilitate growth for their current and future franchisees. MBFC SBA 5Refi Lender Checklist.

Loan Applications Download this Form.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.