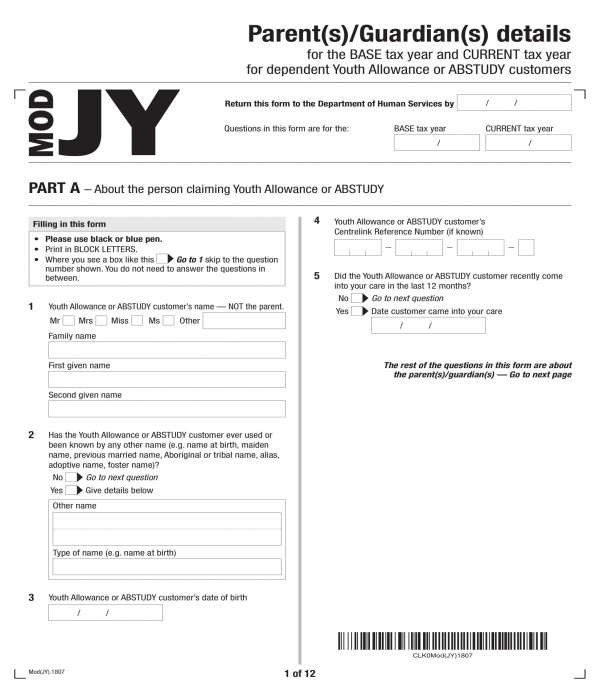

Use this number if either:. Mobility Allowance , Carers Payment or Carer Allowance. Youth and Students Line. If you need a number that is not here you can go directly to the Centrelink contact page to get a more detailed list. Austudy - a payment for full-time students and Australian apprentices aged years and older.

ABSTUDY - a living allowance payment plus a range of extra benefits for Aboriginal and Torres Strait Islander students and apprentices. This may include a natural disaster, public holiday or system maintenance. Help in an emergency Information about payments and services for people recovering from a major disaster or in severe financial hardship. Employment Services Newstart for job seekers and over.

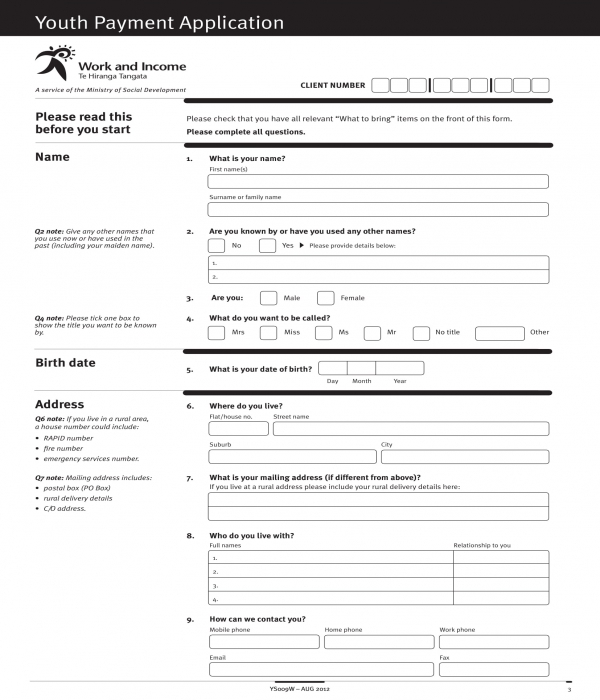

So basically, I got approved for youth allowance a couple of months ago. You must be between and 24. These groups will now be entitled to an extra $5a fortnight, doubling their payments, after the package passed Parliament on Monday night. In the form, the representative of the group should state the name of the group, the date of when he used the form, the electronic mailing address. The payment is available to Australian residents and newly arrived migrants after 1weeks as an Australian resident in Australia.

We know you may not be able to do some of these things due to COVID-19. The Student Start Up Loan has replaced the Student Start Up Scholarship. If you select a percentage of your payment to be withheld as a tax deduction, the corresponding amount is rounded down to the nearest whole dollars. For example, of $225.

Tax File Number Exemption for Commonwealth Seniors. The amount is $2per year if you’re single or $1if you have a partner. This amount will increase over time to keep up with inflation. I keep getting rejected as my parent earns too much (~120k a year).

I have had to move and do have to pay rent. I am classified as dependent but I know other people in a similar situation that are receiving payments. A number of different countries operate different versions of the program. That number is the point at which your partner would not be payable for their Centrelink payment. This allowance is designed to provide financial help to young people to study or train in an occupation.

Newstart and the remainder received Austudy or Disability Support Payment benefits. Personal income upper threshold $524. Part allowance income limits Family Situation Single, under 1 at home Students and Australian Apprentices $857. My course is an approved course for youth allowance.

ACOSS social sector organisations, leading economists, the Henry Tax Review and even the business community. The accumulated income bank credits can be used to offset any income earned that exceeds your fortnightly income free area. Tried calling alternative numbers and waited hours before hanging up. About $3more each month. I’ll be able to pay my rent and bills on time.

Federal government websites always use a. Before sharing sensitive information online, make sure you’re on a. I do not believe Centrelink has been setting aside tax for me in its payme. Anyone who is eligible for the coronavirus supplement will receive the full rate of the supplement of $5per fortnight,” the federal government said in a statement. Tax-free allowance for children (Kinderfreibetrag)Under certain conditions, a tax-free child allowance may also be granted to parents.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.