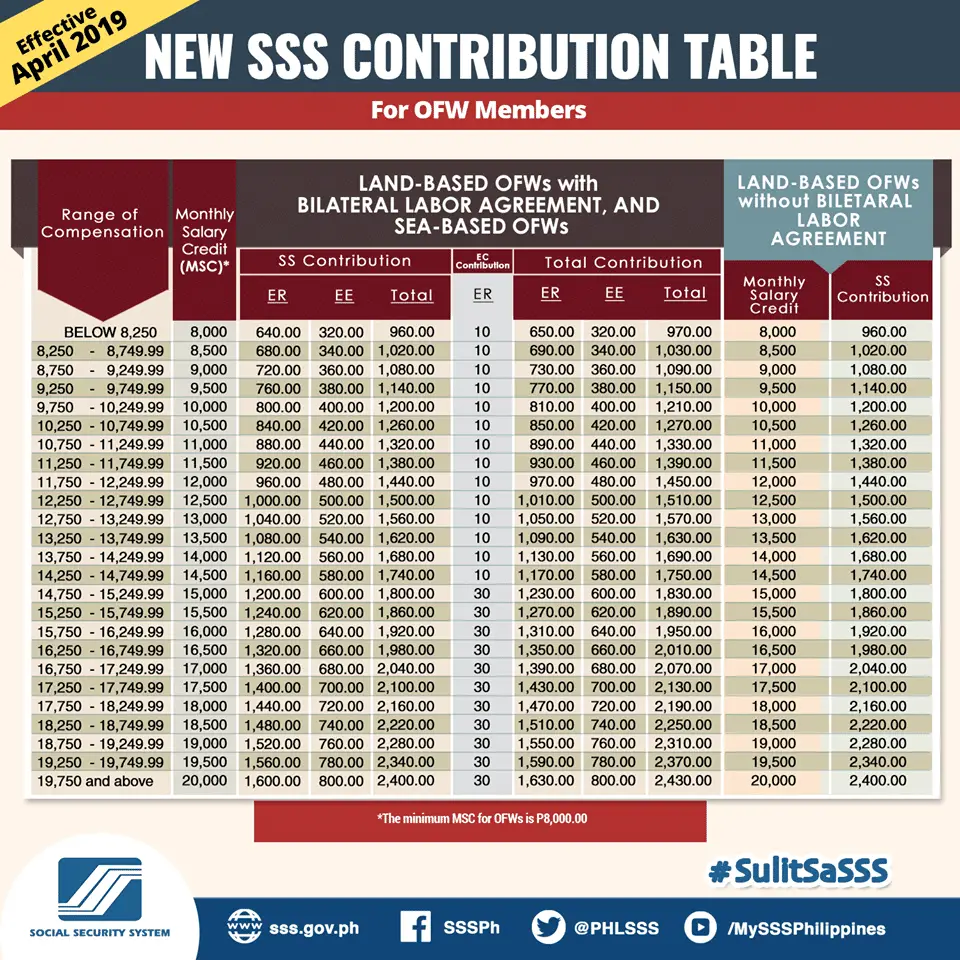

Based on the SSS contribution table below, your employer pays P770. The total contribution includes a small payment to the Employee Compensation Program, which is P10. For Employed Members , the minimum monthly salary credit is PHP 00 with a total contribution of PHP 25 while the maximum monthly salary credit is PHP 200 with a total contribution of PHP 430. Where to pay your SSS payables?

How to pay SSS contribution in the Philippines? One of the main is the SSS Online Payment. Currently, all OFW’s can utilize this mechanism and pay their contributions by SSS e-Services! To learn more about contributions , click SSS Contribution and check out!

In this way, it is necessary to pay monthly the contribution so that members can gain access to the benefits. However, taxpayers can access a huge advantage: SSS online payment. Putting a check mark on the correct option or box will change the membership status from covered employee, self-employe OFW, or non-working spouse to a. This means you can pay contributions from January to December of the current calendar year only.

Ways to Pay Your SSS Contributions while Working Abroad. However, you cannot pay for your previous years’ contributions because it would entail a lot of records updating. Finding where to pay your SSS payables can be a headache. Domestic Workers Act or the Batas Kasambahay, the employer pays the entire contribution if the kasambahay earns less than five thousand pesos (PhP 000) per month.

The monthly contributions off SSS Members are based on the compensation. In the past, tracking one’s monthly SSS contributions used to involve visiting an SSS branch or calling the agency’s hotline for self-employed workers and coordinating with the HR department for employees. Once you become an SSS member, you’re covered for life even if you miss your monthly payments.

There’s no penalty for individual members who fail to pay their contribution for a certain period. However, the SSS doesn’t allow members to make retroactive payments just so they qualify for a loan or benefit. State-run Social Security System ( SSS ) recently partnered with PayMaya to allow members to pay their contributions via the SSS Mobile App. Thanks to this partnership, individual members of the pension fund such as Self-Employe Voluntary, and Overseas Filipino Workers (OFW) can now pay their contributions using their PayMaya account or any Visa, Mastercar or JCB credit, debit or prepaid card.

It’s easy to get started paying SSS contributions with GCash. In the next field that will appear, enter the PRN and click submit. Please refer to the SSS Contribution Table below according to your membership whether you are an employed member, self-employe voluntary. In a text message, Ma.

Luisa Sebastian, SSS Vice President for Public Affairs, stated that the new rate must show in the contributions to be paid in May, for the increase in contribution rate will be implemented in. How to Generate a SSS PRN and Pay Your SSS Contributions Online with Taxumo. Here are the steps to generate a PRN and pay your SSS transaction through Taxumo. Easy Steps to Pay Your SSS Contributions and Generate PRNs Online.

For SSS Members who have stopped paying for their SSS Contribution and who want to continue paying their SSS contribution again, including OFWs or Overseas Filipino Workers. You can continue your SSS contributions provided you have valid payments of SSS contributions in your records. The Philippine Social Security System ( SSS ) released the new contribution schedule following President Rodrigo Duterte’s signing of the Republic Act No.

According to the new law, SSS members and their employers will now be paying monthly contributions from the current monthly contributions. Sign-out and re-login, and try the payment process again. Delete the SSS Mobile app and re-install, and try the payment process again. Kung ganun pa rin, baka may bug yun app. For self-employe OFWs, and voluntary members, your salary credit will depend on your declaration of monthly earnings at the time of registration.

Make sure to generate your Payment Reference Number before you proceed to any of the listed payment centers. The new payment schedule allows regular employers (ERs) and household employers (HRs) who are paying contributions monthly, can pay their obligations until the end of the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.