Self-employment verification. Separation agreement. Shared well agreement. Social Security card. Statement of explanation.

Submit this document to show your monthly household expenses and outstanding debts. Check the status of your loan modification. This form documents the reasons for your hardship. Third-party authorization.

For more information, visit our Tax Center. What does a secured loan and unsecured loan mean? Is a secured loan a good option? Complete an online application to qualify. First-time homebuyer?

Our home mortgage consultants can help you get started with a free consultation. Get Started Online Today! JND Legal Administration P. If you have a question about a document , print this checklist and write your question in the. The bank, the largest U. You could not and no-one else going in the same way as books amassing or library or borrowing from your contacts to get into them. This is an definitely easy means to specifically acquire guide by on-line.

A bank investigation found that some. CHECK YOUR MORTGAGE DOCUMENTS FOR THESE ROBO-SIGNATURES! Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N. Upload required documents and see them in your loan file With your LoanTracker , you can submit your documents electronically. You can determine your LTV by dividing your loan amount by the lesser of the appraisal or the purchase price.

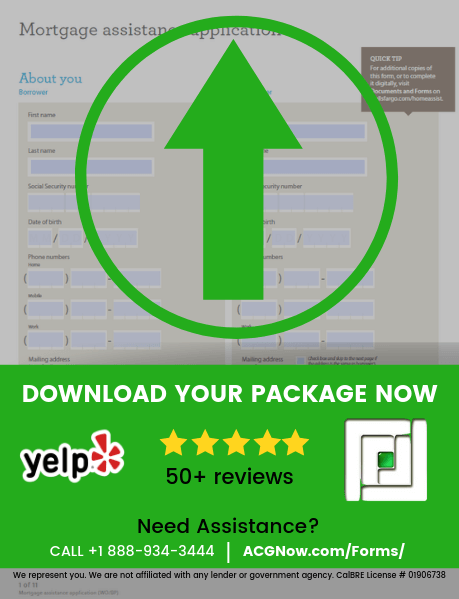

Why Waste Time Looking For a Mortgage? Click here to tell us your story. Please see your tax advisor to determine how this information may apply to your own situation. Checklist of required documents Owner-occupied commercial real estate This checklist will help small business owners identify what documentation is required during the loan process. Prompt submission of the required documents will ensure timely processing of the loan request.

Additional documents may be required to clarify or support the loan. WFA customer orders are generally routed by WFCS to non-affiliated broker-dealers and exchanges on an agency basis. A customer who is deaf enters a store and asks for an interpreter to discuss mortgage products. An increase in interest rates will affect the overall cost of borrowing.

All securities and accounts are subject to eligibility requirements. Clients should read all lines of credit documents carefully. Sign in to have your application prefilled with your personal information. Enter any additional information about your employment, income or assets.

Copy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be receive and Copies of your two most recent bank statements or other third-party documents showing receipt of payment. This loan provides flexibility – a term length of between two and six years depending on the collateral – and the. Stumpf, agreed to pay $17.

Getting through the weeks and months ahead. This is merely an overview of information that might be helpful in getting you started on the estate settlement process.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.