Mail return without payment. Updated on July 10:AM by Admin, TaxBandits. Make sure that you have entered the correct address. The mailing address will vary based on: 1. Where your business operates 2. With payment, the address is Internal Revenue Service, P. See Deposit Penalties in section of Pub.

Specific Instructions Box 1—Employer identification number (EIN). Powerful and Easy to Use. At the same time, the IRS encourages employers to consider filing their federal employment tax returns electronically. Which mailing address you’re going to use whether it is with or without the payment depends on the state you’re living in. Users are seeing under days.

Growing Thicker Stronger Hair Fast. Visit this page on the IRS website to find the correct address. However, a time frame is applicable to report overreported and underreported taxes. The IRS calls this time frame a “period of limitations. Employers will be able to get their IRS filing status instantly and the total filing process will take less than minutes.

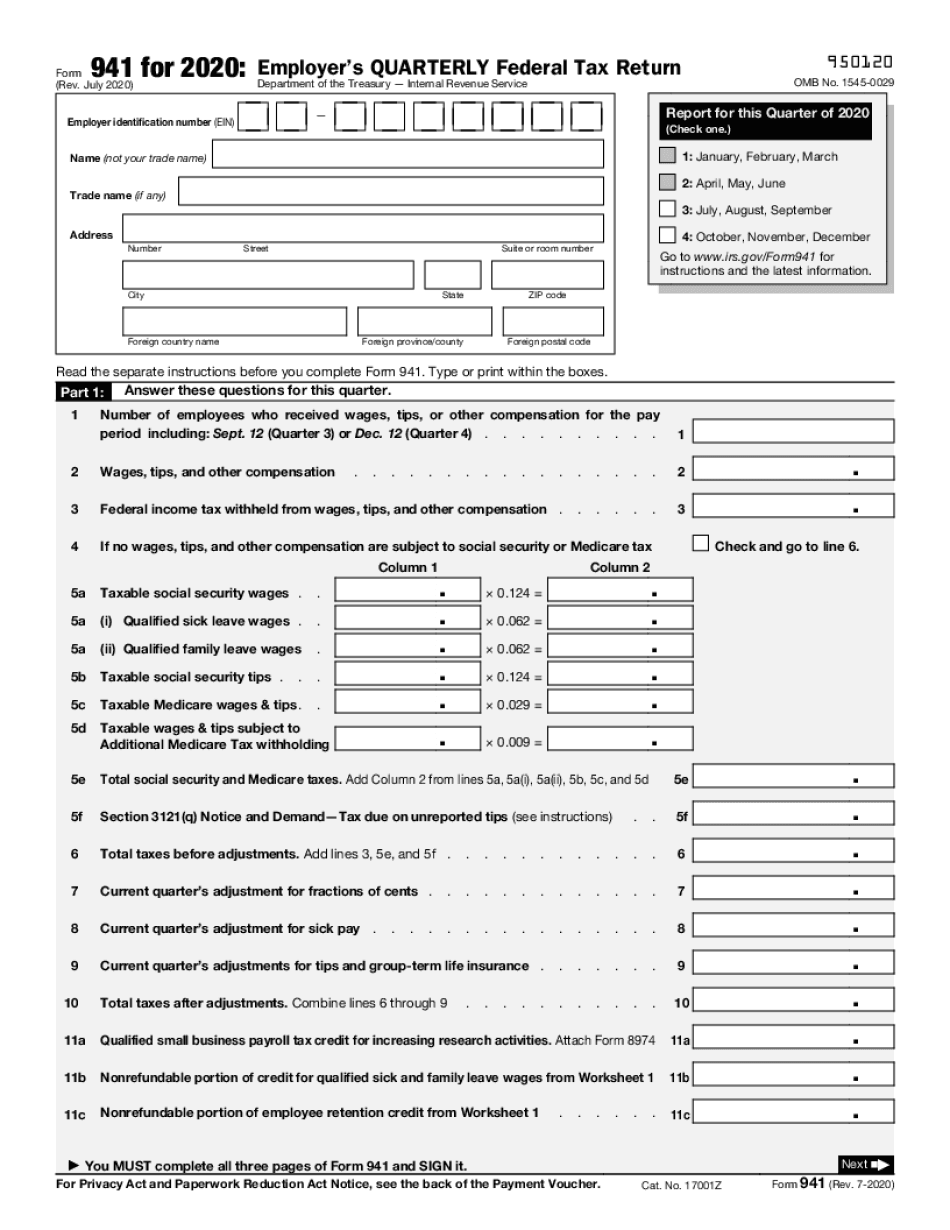

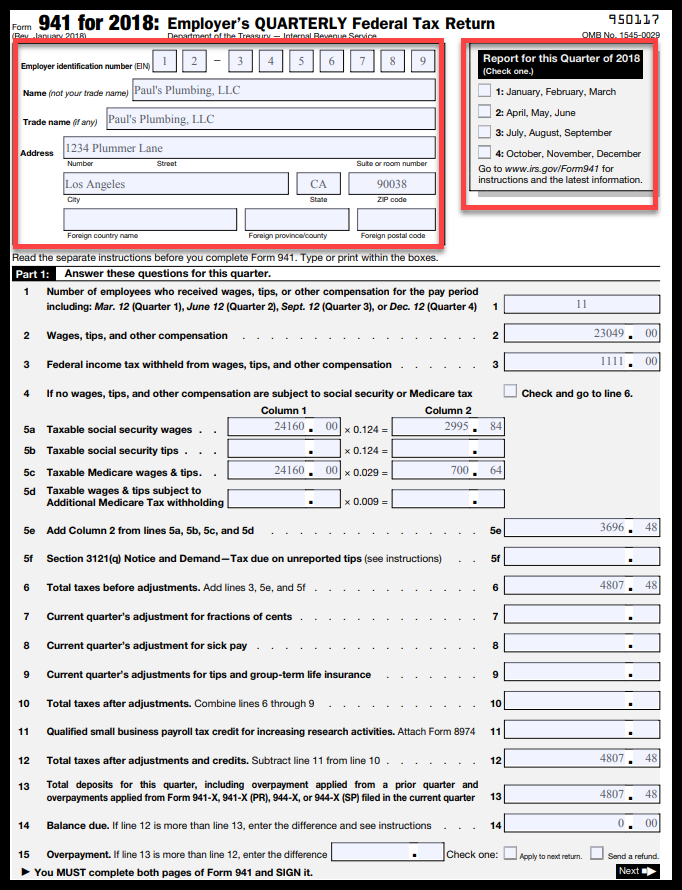

Typically, a business will file. Search For Help With Irs. Form 9filing methods. Note : Only semi-weekly depositors are required to file form Schedule B, when any other deposit frequency is selected a Schedule B will not be e-filed and you will likely receive a tax notice.

Depending on the service provider, you can submit the information at a physical location or mail the information. Filers submitting amount under $5can submit using EFW (Electronic Funds Withdrawal) with a valid bank account and routing number. Customize Your Template Instantly.

Prepare your quarterly return from any device without installing any software. The secure filing system forwards the information to the IRS agency. The filing system sends you an e- mail that indicates the IRS has received your e-file enrollment request. Fill in Pages through 3. Generate, downloa and print the forms. You can send the printed forms to the IRS.

If you want to claim a refund for the overpaid taxes, you can file a 9-X form any time before the period of limitations expires. Send the form with payment to the Department of Treasury. If you’re wondering where to mail form 9without payment or with payment, check IRS locations here, because businesses in different states file 9quarterly to different IRS locations. Report your tax liability accurately.

Submit valid checks for tax payments. Select the correct date range from the drop-down menu. Save And Print - 1 Free! Create Your Free Account. It is based on what state your company is located.

You must make monthly or semi-weekly deposits of payroll taxes collected. If your total payroll tax amounts are $50or more or if you had a tax liability of $100or more this year or the year before—you are a semi-weekly depositor. The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. The 9form reports the total amount of tax withheld during each quarter. Federal law requires an employer to withhold taxes from their employees’ paychecks.

We Have Everything You Are Looking For! Explore the Best Info Now.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.