Free Loan Agreement In Your Browser. Comprehensive, Print 1 Free! Sample Loan Agreements - Start Now. Download To Word And PDF Instantly. Hundreds Of Templates At Your Fingertips.

Unsecured Loan – For individuals with higher credit scores, 7and above. Does not require the borrower to provide collateral. Step – Sign the Agreement.

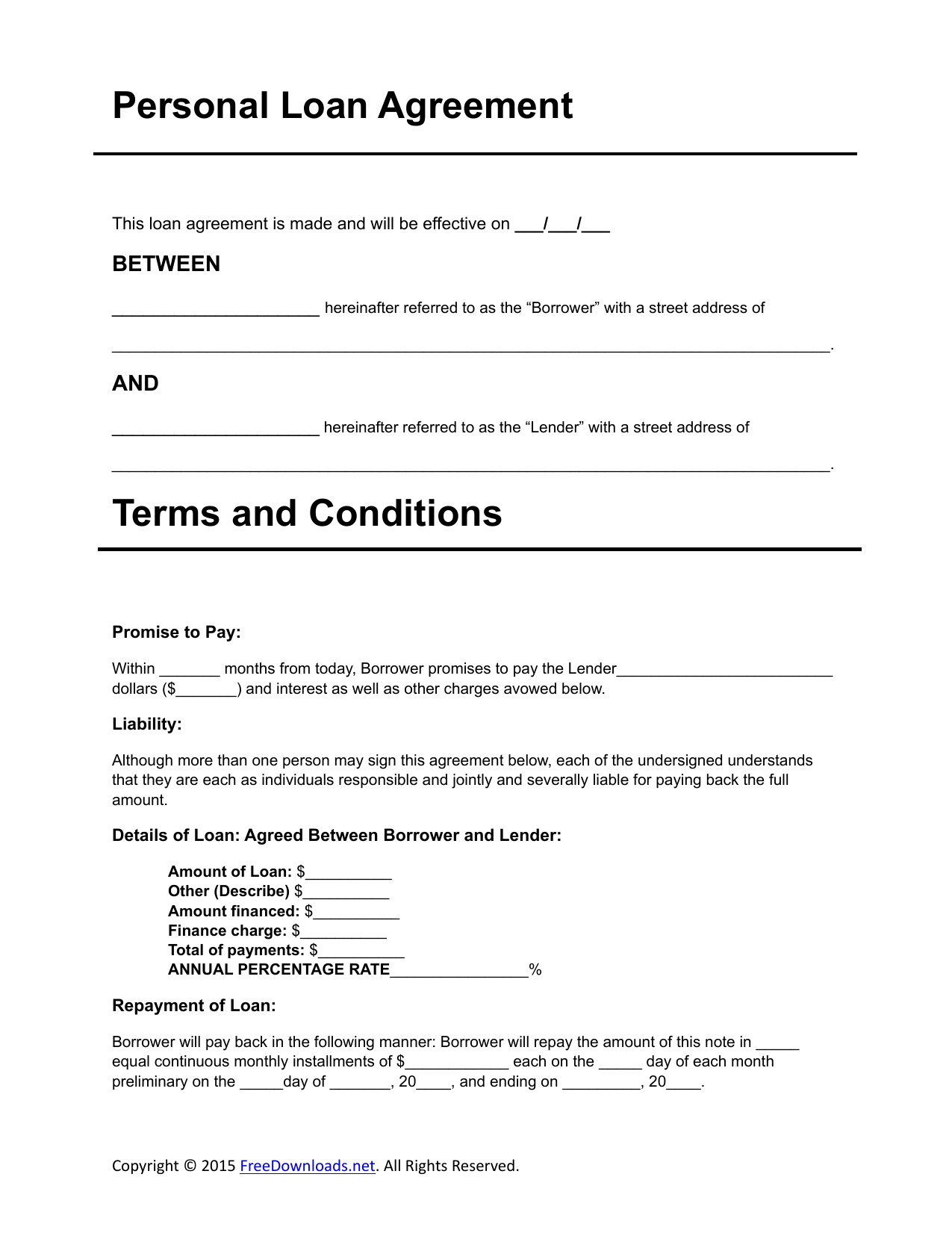

An unsecured promissory note is a simple agreement form that accompanies a loan. The purpose of this document is to outline how the borrower (the person receiving money from a bank or another lender) promises to pay back the money. The law in this unsecured loan agreement There is little statutory regulation relating to an agreement of this nature, so you can make, more or less, the deal you choose. Drawn outside the consumer credit legislation , this agreement is not suitable for companies in the business of lending or providing credit to consumers.

It’s of utter essence however to note that family loan agreements are totally unsecured since the person borrowing the money is a family member or a close friend. This is to say that there are no assets taken as collateral incase the family member fails to pay back the money. Personal Loan Agreement Template: The personal loan agreement is an unsecured contract that allows one party to borrow money, the borrower, from someone else, the lender, in exchange for the lender to be paid… Adobe PDF. One person might call the loan contract a promissory note or a promise to pay.

Another might reference the document as a demand loan or a term loan. If the loan terms are in the title of the loan , the document template title is a secured loan or an unsecured note. What are risks of an unsecured loan? What do you need to know about unsecured loans?

Is it better to get a secured loan or an unsecured loan? Write A Quality Loan Agreement In Minutes With Our Custom Made Templates. A guarantor is a person who promises to pay and meet all the obligations of the borrower if the borrower fails to pay or meet those obligations. Secure Cloud Storage. The parties hereto agree that the Loans provided under this Agreement are unsecured.

For Business Or Personal Use. Get Started On Any Device. A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule. So, if your loan agreement is unsecured and there are no co-signors or guarantors to assume responsibility, you may not be able to collect any money.

For smaller or personal loans , the borrower may offer tangible goods such as jewelry, electronic equipment, a vehicle etc. Learn more about unsecured loan agreement , which is a document covering the terms of an agreement for you to borrow money from somebody else. Browse our various legal documents across different industries, and explore the business legal advice offered through the LawBite website and app. THIS AGREEMENT , made and entered into this ___ day of _____, 201__, by and between (business name and address), Kansas (Zip Code), hereinafter sometimes referred to as “Company,” and (County) County Economic Development E-Community Fun hereinafter sometimes referred to as “Provider” for Network Kansas funds.

Interest rate on unsecured loan from directors. It might completely depending upon the mutual agreement between the company and its directors. A loan agreement between two individuals is more simplistic but very similar to a standard bank promissory note. When this agreement is effective, the borrower has to return the money on the agreed terms and conditions.

The lender can’t force anything new on the borrower. Both parties are obligated to respect and follow the guidelines included in the agreement until all the money is returned to the lender. Unsecured loans come in three main forms: personal loan , student loans, and unsecured credit cards. Common examples include credit cards, personal loans and student loans.

Here, the only assurance a lender has that you will repay the debt is your creditworthiness and your word. For that reason, unsecured loans are considered a higher risk for lenders. Its primary function is to serve as written evidence of the amount of debt and the terms under which it will be repai including the rate of interest (if any).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.