What is authorization vs capture? Does Stripe support stripe? How to authorize a payment without capturing it? Reviewing uncaptured payments. By default, with Stripe you create payments in one step, and with no further action on your part the funds will be sent to your bank account.

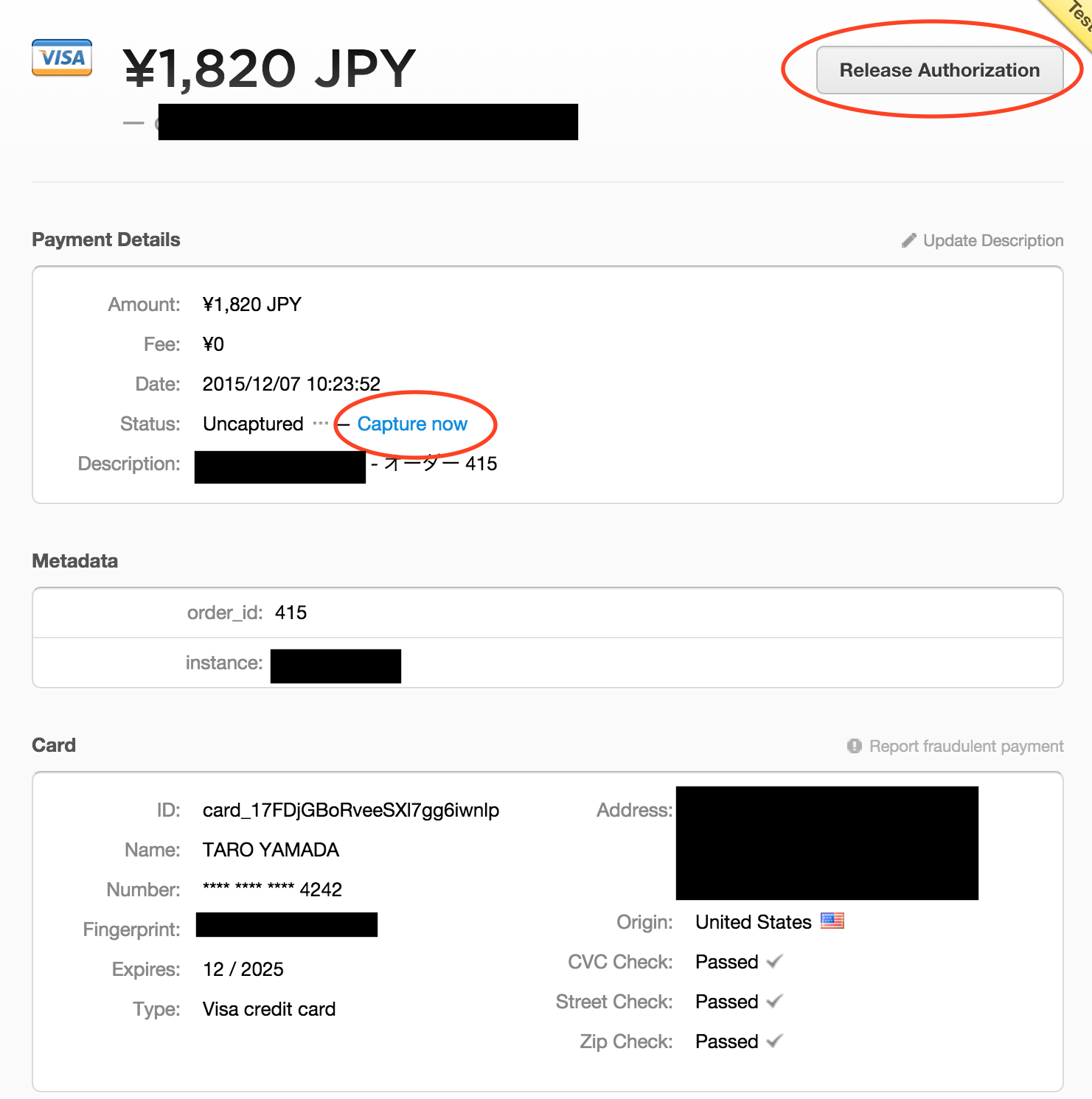

However, Stripe also supports two-step payments, often called auth and capture. If your integration uses this technique, it’s important to understand that approving a review and capturing a payment are separate actions. It’s like two-phase commit for payments. This makes some new payment flows possible—most notably, capturing funds only when an order is ready for shipping.

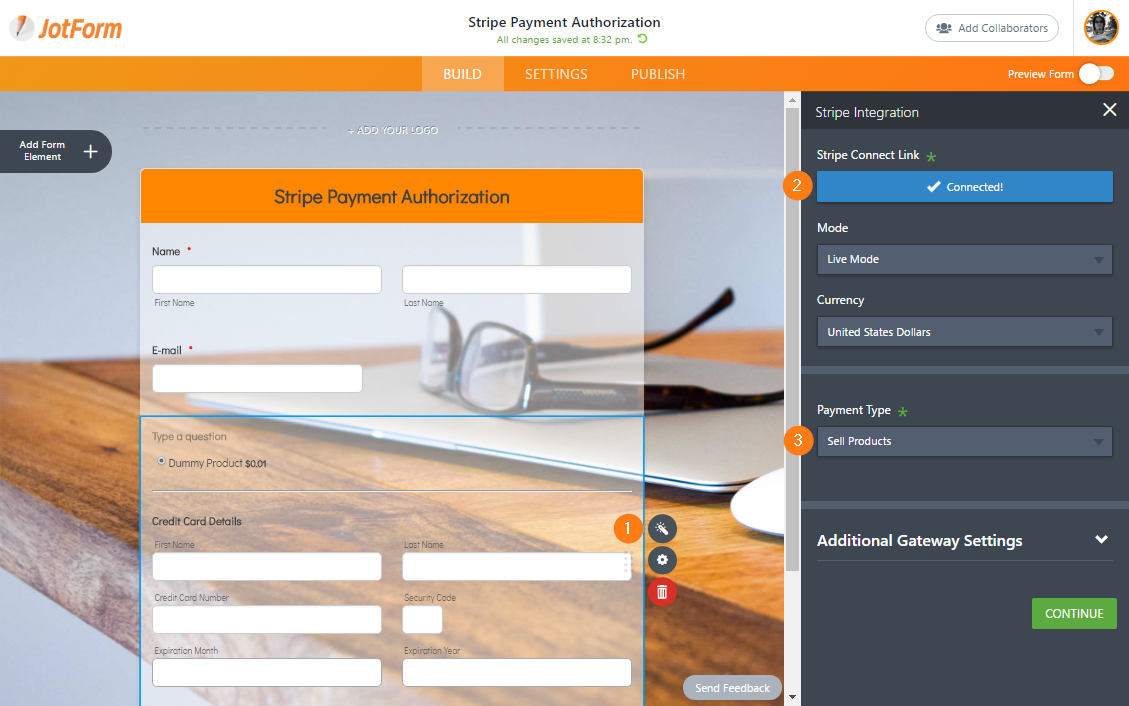

To use it, you just set capture = false when you create the charge. Tell Stripe to authorize only. To indicate that you want separate authorization and capture , set the value of capture _method option to manual when creating the PaymentIntent. This parameter instructs Stripe to only authorize the amount on the customer’s card. Ruby Python PHP Java Node Go.

Get your questions answered and find international support for Stripe. If the merchant changes the authorization by performing an incremental authorization or partial capture , you can look at this field to see the previous states of the authorization. Capture the funds of an existing uncaptured PaymentIntent when its status is requires_ capture. Uncaptured PaymentIntents will be canceled exactly seven days after they are created. Learn more about separate authorization and capture.

Placing a hold on a card. Use the Charges API to authorize a payment now, capture funds later. Stripe supports two-step card payments so you can first authorize a charge, then wait to settle ( capture ) it later. When a charge is authorized , the funds are guaranteed by the card issuer and the amount held on the customer’s card for up to seven days.

First, let’s spend some time going over a few key terms. This is what’s happening in the seconds or minutes after a customer swipes their card and before they sign on the dotted line. When “Approved” flashes on the screen, the funds are earmarked for that particular business and transaction – the customer can’t spend those dollars anywhere else.

They’ll see their credit limit decreased by the amount of the transaction and be able to view the charge in its pending state in their online account. By the way, we wrote a detailed blog on how an authorization is obtained. You can read it here. Capture, on the other han refers to the process by which a transaction moves out of the pending state and you get your money. Basically, the business owner must give the “thumbs up” to the transaction within a certain number of days to.

See full list on 360payments. Depending on the type of business you have, it may be advantageous to extend the time period before the authorization and capture by a few extra days. Some examples are hotels, who often issue pre-authorizations to cover incidental charges during a guest’s stay, restaurants, who may need to wait and see what tip the customer would like to leave, and ecommerce businesses, who may wish to wait until an order has shipped before charging the card.

So how long does a business owner have to capture funds? The answer varies between credit card companies and even between payment gateways. Your credit card processing provider can help you navigate the rules for your situation.

In general, however, authorizations will expire in about five to ten days. The charges will simply “fall off” the customer’s car and they won’t be charged. From the business owner’s perspective, those funds are no longer earmarked for you and you can no longer access them. If you decide you’ve made a mistake and really did mean to capture that money, you’re out of luck.

You’ll need the customer to re-swipe their card (basically make another purchase) in order to generate a new authorization. That’s what we’re here for! We understand that the payment process can get confusing and that there’s a lot of conflicting information out there. Our customers don’t need to worry about this kind of thing.

Why did you read this blog then? Here’s why you really should rethink things. PPS – While we’re at it, are you taking chip cards yet? EMV compliance is a big deal. Read all about it here.

Content updated daily for stripe payment system. Here we have everything you need. Our support center provides on all types of situations, including account information, charges and refunds, and subscriptions information.

Find help and support for Stripe. But it seems Stripe requires you to create the customer to authorize the car but this is a bit silly since the logical flow should be this: Validate form input via stripe. This can be useful for merchants who have a delayed order fulfillment process. Authorization and capture enables you to authorize fund availability but delay fund capture.

This is due to gateway limitations on how authorizations need to be captured to match the requested authorization. Authorize and Capture (AUTH_ CAPTURE ) For a transaction to be completed successfully, you need to perform an authorization and a capture on the transaction. Transaction Processing - The merchant can process stored value transactions from the point of sale.

These transactions are delivered to Chase Merchant Services’ authorization system for processing in real time. Capture means the transaction is submitted to the financial institution of whoever is paying. Settlement means you actually get the money.

Fast on Teoma.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.