Income tax is an annual tax imposed separately for each assessment year (also called the tax year). Assessment year commences from 1st April and ends on the next 31st March. It is deductible from income-tax before calculating education cess. Section of the Income-tax Act further provides. The amount of rebate is 1per cent of income-tax or Rs.

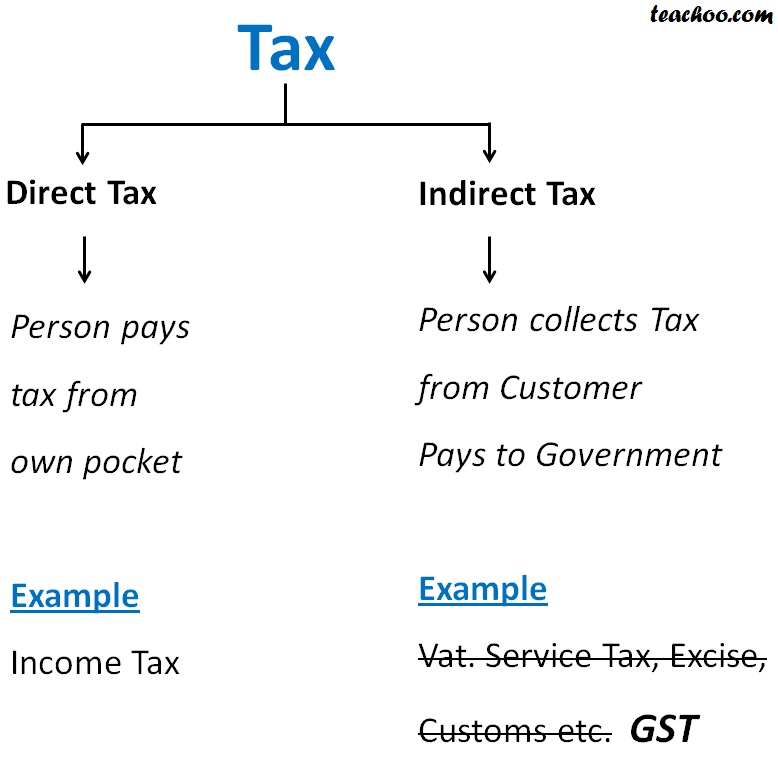

Out of a Central tax revenue of Rs. Investment climate 1. The power to levy taxes and duties is distributed among the three tiers of Government. While direct taxes are levied on taxable income earned by individuals and corporate entities, the burden to deposit taxes is on the assessees themselves. A direct tax cannot be shifted to another individual or entity.

Transition to INTIME to send messages regarding your Retail Sales, Withholding Tax or other business tax accounts. Disclaimer: Updating and uploading of all Central Acts available on this web page is the proprietary of the Legislative Department in the Ministry of Law and Justice. The updating and uploading of Rules, Regulations, Notifications, etc. Principal Act under which the said subordinate legislations have been made is the proprietary of the.

By Harish Salve The art of taxation consists of so plucking the goose as to obtain the largest amount of feathers with the smallest amount of hissing. The central government, state governments, and local municipal bodies make up this structure. There are two types of tax in india i. The income taxed by this act can be generated from any source such as profits received from salaries and investments, owning a property or a house, a business, etc.

Taxes are levied in almost every country of the worl primarily to raise revenue for government expenditures, although they serve other purposes as well. Learn more about taxation in this article. If you have problems opening the pdf document or viewing pages, download the latest version of Adobe Acrobat Reader. TAXATION IN INDIA : Foreign Exchange He. NMIMS 4PDF 4cheap 4Free 4LIFESTYLE PRODUCT 4study.

Indian tax reform experience. A resident company is taxed on its worldwide income. In this article we will discuss about the principles of taxation. The most important source of government revenue is tax. A tax is a compulsory payment made by individuals and companies to the government on the basis of certain well-established rules or criteria such as income earne property owne capital gains made or expenditure incurred (money spent) on domestic and imported articles.

Corporate Tax Rate reduced to for new mfg companies and to for existing companies, the lowest in the world. This is significant as after this the administration of the Income Tax came under the direct control of the Central Government. THE INDIAN LEGAL PERSPECTIVE 3. Tax rates for individuals are common for all, irrespective of their residential status.

The local bodies are allowed to collect octroi, property tax , and other taxes on various services like drainage and water supply. In addition, gifts from specific relatives like parents, spouse and siblings are also exempt from tax. Gifts in other cases are taxable. STCG are taxed at. Besides this, the both long term and short term capital gains are taxable in case of debt mutual funds.

Tax Invoice Format in Wor Excel, PDF Format All types of Tax Invoice Format in Excel, Wor Pfd and other bill Format like. That is, many people view a tax as fair if taxpayers with the greatest ability to pay have the highest tax burdens. Nevertheless, the term fair tends to have different meanings to different people. For example, with respect to an income tax , consideration of a fair income tax system might arise if: 1. A sound tax system should identify surpluses in the economy and should tax it in such a fashion as to cause minimal damage to productive activity.

Tax collection should act as a catalyst for economic growth. Ideally a tax system should be neutral with respect to its effect on economic behavior.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.