Ask About Income Tax, Get an Answer ASAP. Get the You Need Online! Be Connected Online in Minutes! Questions Answered Every Minutes.

Lenders’ requirements for proof of income for mortgage applications will differ. Typically, earned income is evidenced in the following ways: Payslips : The standard requirements are three months’ payslips and two years’ P60s although there are lenders who will accept less than this. The UK document can be adjusted to suit your exact requirements before the final document is completed. We provide novelty Proof of Income in both printed and digital versions.

If you want us to print your novelty Proof of Income document according to your requirements, it is printed on a 1gsm paper. Can you get a mortgage with no proof of income UK? What is a proof of income letter? Should I write a nanny proof of income?

The government or bank may require proof of income letter for many things and one of those is verification of the salary received by the person. If you need proof of a benefit claim If you need proof that you’re getting a benefit – such as a printed record – contact the benefit office that pays you. This can be used to show your work.

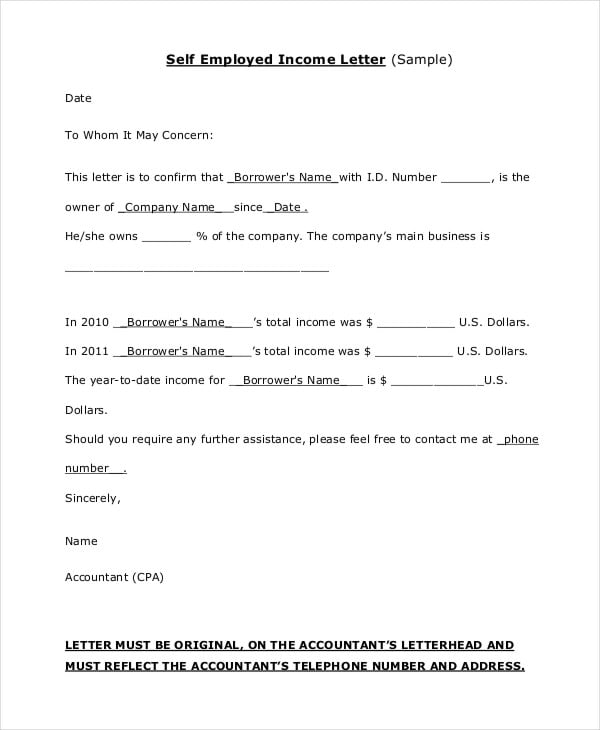

Proof of income letters is a document that provides information about your income. Luckily, showing proof of income as a self-employed individual is a lot easier than most realize. The most important thing to keep in mind when proving your income is to keep constant documentation. Keeping your tax returns, profit and loss statements, and bank statements all in the same place will make proving your income easier down the road.

Create a Pay Stub From Scratch With Our Easy to Use Platform - Export Free! Make sure your work is protected. This was known as ‘self-certifying’ and meant you could get a mortgage even if your income varied from month to month. For example, we may need proof of income or confirm the identity of a joint applicant. These requests could be for you or the joint applicant.

In some cases we may need information from both of you. The letter includes important details that relate to your income. You can opt to write the letter, or your employer, accountant or social worker can write the letter. At no point was I asked to provide evidence of my salary history. You may be able to get a buy to let mortgage without any proof of income if you have other sources of income such as a redundancy, other investments, a. UK income tax rates are stepped depending on your income.

These steps, or bands, are also used to determine other tax rates, such as capital gains. Approximately million people pay taxes in the UK. Your income is a factor that can determine a number of things from your health insurance plan to the amount you receive for a personal loan.

Search for Income Verification. Get a Income Statement - 1 Free. Print or E-File Online.

An award letter or income verification letter written by an official from the issuing office may be adequate to prove your unemployment income. Wait for your W-to arrive at the end of the year, if you are not required to produce proof of income immediately. Unemployment income is generally considered taxable income. Written quotations are available on request. Available to UK residents aged and over.

Prices may vary in Northern Ireland. As an aside, I'm from the UK and have applied for fintech and big bank jobs before. Provident is a trading name of Provident Personal Credit Limited. Bank statement or other proof of income uk visa.

Active year, months ago. Easily confirm employees’ salaries when they apply for loans, credit cards, housing, and mortgages. With this Income Verification Letter PDF Template, you can provide proof of income in the form of secure PDFs your employees can easily downloa print, and share with banks, landlords, and other agencies.

Property owners will usually ask prospective tenants to provide at least two different documents that verify proof of income to protect themselves from fraud or scams. You definitely want to get documentation for commission-based tenants, like real estate agents and mortgage brokers. Pro: Commission-only tenants can have great income and can be great tenants.

Con: Very hard to prove that this income is reliable. Three quarters of credit cards including Lloyds and Halifax, take applications from people without earnings. Five years ago credit cards demanded applicants earn at least £10a year.

Find Income Verification Get Info at Consumersearch.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.