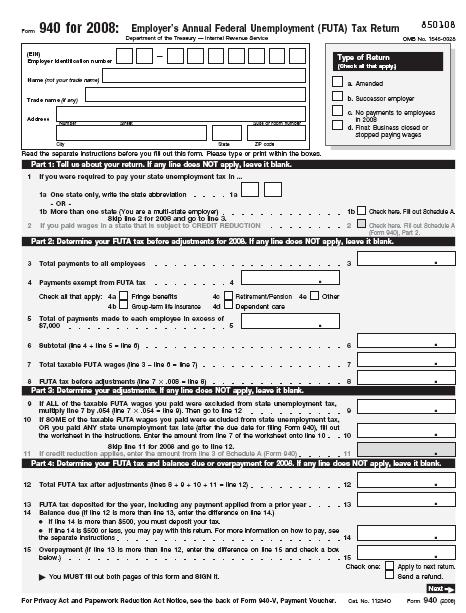

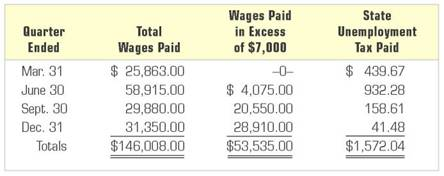

Where do you file Form 940? What is 9and 9tax form? See Topic 7for more information about Form 940. The standard FUTA tax rate is on the first $0of wages subject to FUTA tax.

Employers must report and pay unemployment taxes to the IRS for their employees. Create Legal Forms Online in Minutes. Edit and Print for Immediate Use. The liability on 9line 16d is incorrect. If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line by 0. Review the information below to determine how.

IRS form 9is an annual form that needs to be filed by any business that has employees. The business is responsible for the tax and does not come from employee wages. When you add a new employee, we file a new-hire report with your state on your behalf. Select your state below to see other taxes and forms that are filed and paid on your behalf.

If your address has change please update your account. Access IRS Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Users are seeing under days. Growing Thicker Stronger Hair Fast.

Treasury Department on Treasury Form 940. Determining Your Base FUTA Tax. Question: Cralic Company Has Employees And Operates In Texas. Most employers pay unemployment taxes quarterly, but if the amount you must pay is less than $1in any one quarter, you can wait until at least $1is due. Form 9is used to report an employer’s quarterly payroll taxes.

IRS offer in compromise should be established on a per entity basis. IRS Authorized direct to the IRS. Note: You must also complete the entity information above Part on Form 940. E-filing is not an option. Free Fill in Legal Templates.

Form 9is to report an employer’s annual payroll taxes. You must file a 9tax form if either of the following is true: You paid wages of at least $5to any employee during the standard calendar year. I'm confident that you'll be able to prepare the form 9with the information I've provided.

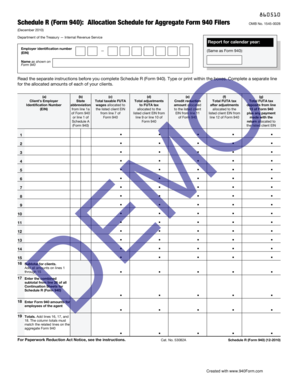

Use this form to report how much you paid your employees, how much you owe in FUTA taxes, and how much you deposited over the year. Texas area code, including Denton and. You can find your credit reduction rate on Schedule A of Form 940. To file Schedule A, attach it to your Form 940.

Enter your total credit reduction on line of Form 940. It acts as a receipt of sorts, which tells the IRS what payments you made. File this schedule with Form 940. To populate the FUTA exempt wages section of the 9form , payroll items must be setup with the proper taxability.

This form helps the employer calculate his or her FUTA taxes. Select a FUTA exempt payment type from the drop-down list. Click Enter to save the payroll item.

To report your FUTA taxes, you need to file Form 940.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.