Sample Loan Agreements - Start Now. Personal Loan Agreement – For most loans from individual to individual. Usually, this is a loan between relatives or friends. Personal loans are usually unsecure but the agreement helps to formalize the loan.

Other articles from doctemplates. What to inlcude in a loan agreement? How do you write a loan agreement? When to sign loan agreement? Does a personal loan agreement need a witness?

The loan agreement , or “note”, is legally binding. A personal loan is meant to meet the borrower’s current financial needs. The best outcome of a loan agreement is the timely payments according to the schedule without the lender having to foreclose, hand over for collection or sell.

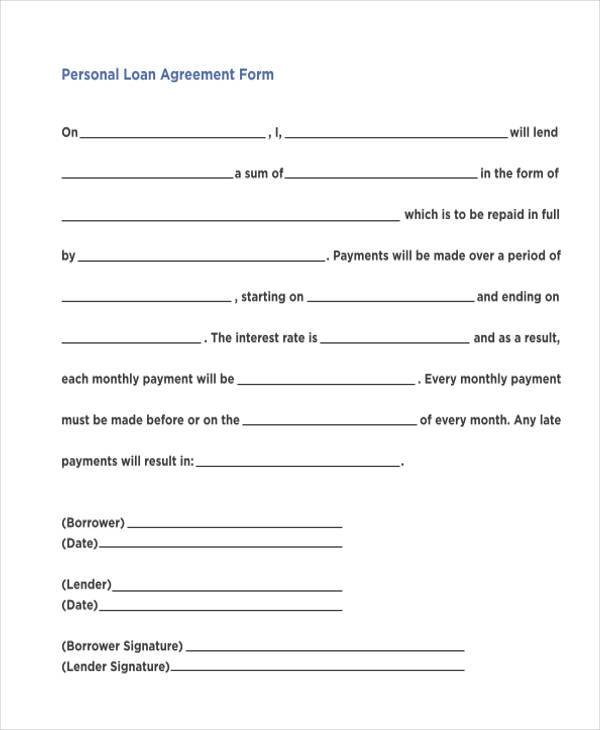

Fill Out Your Form In Minutes With Our Template Builder. A loan agreement details the repayment of the loan and other important terms and conditions. It typically includes the amount, payment details , and your rights as the lender, should the borrower default on the loan. A Promissory Note is similar to a Loan Agreement.

In the treaty, the borrower should state his character, capabilities in paying the loan , and most importantly, a property for his collateral. An IOU agreement is a step above a handshake agreement. It is suitable for small personal loans. If you have questions about making your Loan Agreement , ask a lawyer.

A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule. Save And Print - 1 Free! However, depending on the level of complication involved in the loan , you may want to hire a lawyer to help you with the details of the loan agreement. Dorothy R Silver agrees to give Eleanor S Herrington a loan , and Eleanor S Herrington agrees to pay back the loan according to the conditions specified.

It can be established between you and an official lender, or even between you and another person, like a friend or family member. Elements of a Loan Agreement. Interest: The most important clause in a personal loan agreement , there are two predominant types of interest rates, which are the fixed fee rates, and the floating free rates.

Download To Word And PDF Instantly. It will assign a representative of the company who will be personally accountable to make sure the loan is paid back. Our forms can be easily accessed and are readily available for printing or downloading. Comprehensive For Immediate Use.

Loan agreements between individuals formalize a loaning process, so it is critical to understand loan contract terms and conditions. Learn how to write a formal personal loan agreement using the correct conditions for your needs. Get Trusted Legal Forms.

Free Loan Agreement In Your Browser. This usually includes the date of the loan transaction, the projected repayment date, the amount of money borrowe and any interest rate or other stipulations. The personal loan agreement is an unsecured contract that allows one party to borrow money, the borrower, from someone else, the lender, in exchange for the lender to be paid more money in return of payment. A loan ca be constructed in a number of ways, but the most common is for the borrower to pay back a portion on a timely basis until the. This information is required in order for the lender to determine if they are willing to proceed with the transaction.

Loan agreements are documented via their commitment letters, agreements that reflect the understandings reached between the involved parties, a promissory note, and a collateral agreement (such as a mortgage or a personal guarantee). Loan agreements offered by regulated banks are different from those that are offered by finance companies in. The Loan Agreement Templates We Offer. Before the choosing a template, let’s understand first the concept behind a loan.

Black Law Dictionary defines a loan as a “contract by which one delivers a sum of money to another, and the latter agrees to return at a future time a sum equivalent to that which he borrowed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.