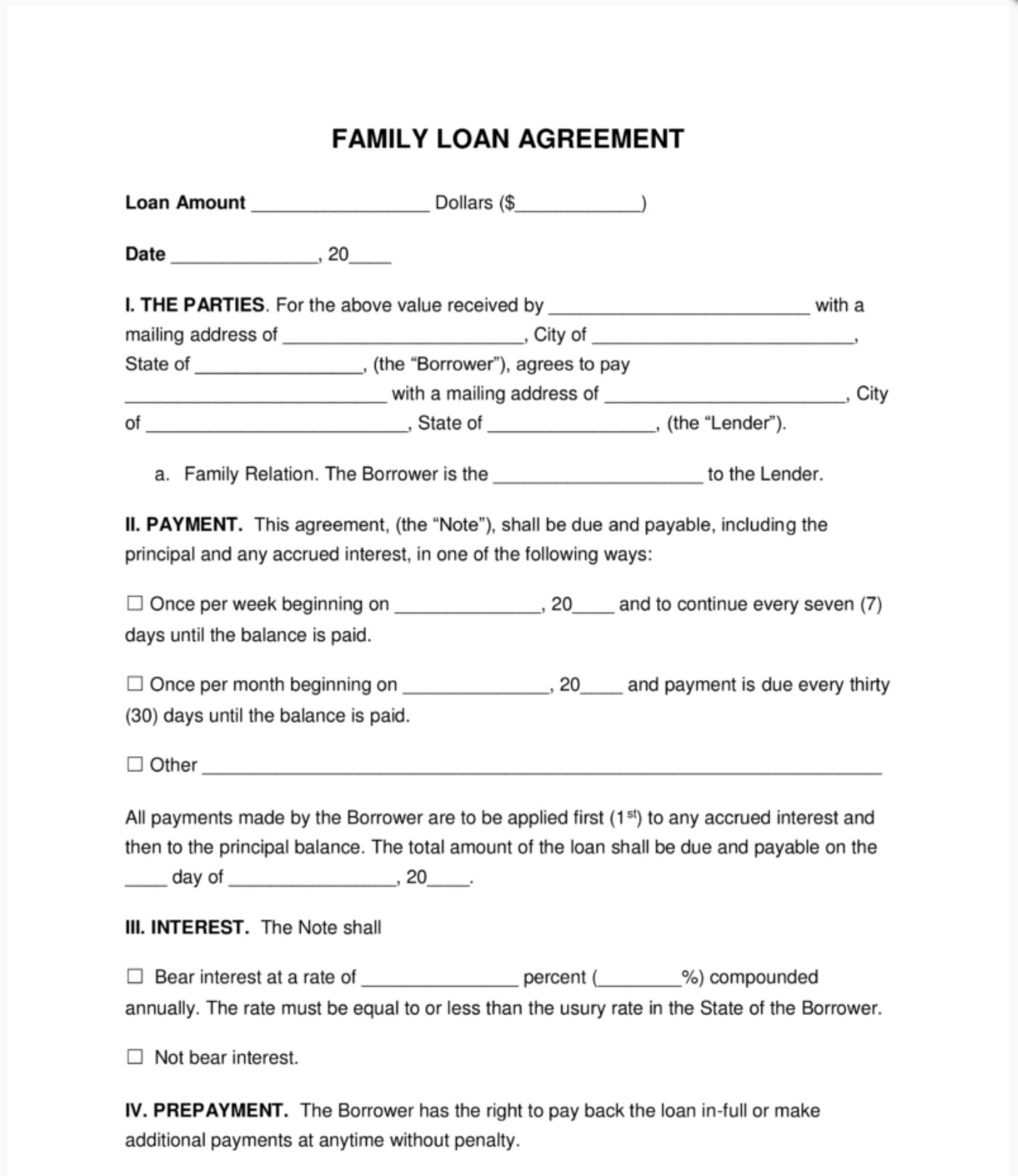

What is Republic finance? Agree upon an interest rate regarding the loan as well as the exact method you intend to use in order to calculate the interest of the loan. Alternatively, if both parties agree there will be no interest charge be sure to include that in the terms of the loan as well.

See full list on requestletters. Clearly outline the loan’s repayment terms in detail. Often, these kinds of loans are repaid immediately after the borrower receives a significant lump sum of money following a financial event, such as a lawsuit settlement or tax refund. If this is the case, be sure to include those specific details concerning the exact event that will trigger the due date.

On the other han if payments will be made for repaying the loan, include a detailed description of the repayment schedule, including the beginning date and final payment date as well as the amount of each payment. Both parties need to sign and date the formal document along with a third-party witness if possible. In fact, they should preferably NOT have a relationship with either party. For instance, an employee at your local bank is an excellent choice to use as a third-party witness since they have zero vested interest in how the loan is collected or in the loan itself. There’s also the option to have it notarized by an official notary public as well.

A loan agreement between two individuals is more simplistic but very similar to a standard bank promissory note. Short: A loan agreementis a legal binding formal document that constitutes both positive and negativecovenants between the borrower and the lender to protect both parties in caseeither party fails to honor their pledges. A loancontract: This is when other parties including the employer if the borroweris involved in paying the loan. The agreement spells out clear. The contract lasts for a specified period oftime.

Promise to Payor Promissory Note. Secured Note: Secured note for loans that have guarant. People borrow money for various reasons, indifferent conditions and from different types of people or institutions aswell. For these reasons, to satisfy the needs of the different types ofborrowers, there exists different types of loan agreements.

Onemight wonder why people should sign forms in such cases, yet this is a familymatter. There are families that are purely legal and official in everythi. Here aresome of the reasons why loan agreements are written. Borrowing money from or lending to family andacquaintances requires agreements to avoid bridging of trust.

Borrowing from or lending money to companies orbusinesses requires an agreement for legal purposes and clarity of theconditions in case of changes in management , changes in business plans amongother reaso. Theinformation on their official names, nationalities, physical postal addresses,gender, age and dependents are given. This is important for location and followup when need arises.

Acceleration _These are details which gives the lender protection from defaulting. Here thedetails of the payment mode, the inte. It is not a sign of mistrust in manycircumstances but at the same time being safe is better than being sorry. Loan agreements serves many purposes ranging fromtrust to formality and legal requirements. Theseagreements benefit both the borrower and the lender.

Without a clear method ofpaying back, the loans might be defaulte or the lender may take advantage ofthe borrower and have all their assets confiscated. Several reasons could propel you toseek a loan agreement of which all will be associated with either borrowing orfully paying a loan. Here are some detailed ideas on why you would require aloan agreement.

Helping people close to someone feels good since itis a moral responsibility. Charging interest on friends , colleagues or familymembers might be hard but at the same time, money stays intact when constantlygrown. One way of growing money is through lending at an interest. Of at all, ifyou want to continue helping, then interest will be important. In doing so youshould consider looking at the stipulated laws governing interests to avoidpain and conflict.

Student Loan – Provided by the federal government or privately in order to pay for academic studies at a college or university. Personal Loan – Between friends or family. This type of loan is known as a friendly loan because the agreement is usually made between friends , family or acquaintances. Family Loan Agreement is a legal binding agreement between two family members that clearly spells out the terms of lending money to a family member with an aim or being paid back after a given duration of time with an accrued interest.

This agreement can also apply to lending money to close friends with an aim of getting back your money with an. If you are seeking a personal loan and are either not comfortable asking for a loan agreement between friends and family or do not have a viable option, then you have other personal loan options. A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule. Sample loan agreement letter between friends “A job search is really a rather stressful time, and it’s more stressful if you believe that your afflicted by something you’ll be able to ‘t control. A personal loan agreement is a binding contract made between private individuals, including family members, friends , colleagues, or even neighbors.

This agreement samples outlines all the details involved in the transaction such as the date of the loan template, the length of time to pay it back, and the interest of the loan , if there is any. Usually, this is a loan between relatives or friends. Unfortunately, memories fade and disagreements do arise.

You may create a legally binding agreement without a lawyer, but if you choose to, one could review it and make suggestions to ensure that it's a mutually beneficial contract. This contract can be renegotiated at any time. Because of their personal relationship with the borrower, most.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.