If you run payroll manually, you might create a payroll report in Excel. It may be easiest to begin by looking for a payroll report template online or within Excel. Remember, accuracy is pivotal when it. In other words, the clock is ticking and you need to make sure you document every expense as soon as you receive funds—or you could run the risk of losing the loan forgiveness.

Documents may include payroll tax filings reporte or that will be reporte to the IRS (typically, Form 941) and state quarterly business and individual employee wage reporting and unemployment insurance tax filings reporte or. These should be very helpful for your application. See full list on bench. The SBA itself doesn’t lend you the money, they just “back” the loan that the lender provides. You won’t need bookkeeping to get your loan.

However, once you get approved for the loan, we highly recommend you get bookkeeping to track your loan spending. This will give you the best chance of getting your loan forgiven. Once you get approved for the loan, ongoing bookkeeping will put you in the best position to prove your spending and get your loan completely forgiven. Reach out to us for a free consultation.

If you don’t have a reliable bookkeeping solution in place, Bench can help. Are proceeds from forgivable loan taxable? What is paycheck protection legislation? You will provide to the lender documentation that verifies the number of full-time equivalent employees on payroll and the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after getting this loan. Do I need any documentation to prove my expenses for forgiveness?

Find Expert Advice on About. The loans can cover payroll support, employee salaries, rent, utilities and other debt obligations as America’s small businesses recover from the economic impacts of COVID-19. PPP loan amounts forgiven. Loans from the Paycheck Protection Program will be available for amounts equaling 2. The SBA states explicitly that the borrower must retain these documents for years.

It also states that the SBA might request access to these documentations in that period. By offering this financing, the SBA hopes to assist small businesses in overcoming financial hardships and keep their employees during this uncertain time. You need to verify your eligible payroll and any non-cash benefit payments during the covered period (or weeks). Documents submitted should include all periods overlapping the 24-week covered period (or 8-weeks if selected).

Payroll documentation. While the bank may have some of these documents on file, the SBA requires you, as the borrower, to supply the documents to validate your expenses. An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis. I resubmitted my application today. If you have employees, you should submit Form 9and state quarterly wage unemployment insurance tax reporting forms, or your equivalent payroll processor records that best correspond to the covered period.

No need for additional payroll documentation - the Schedule C you submitted with your application is your documentation. If your loan was for more than $million, the need to document your justification is even greater given the impending audit by the SBA. We show you top so you can stop searching and start finding the you need.

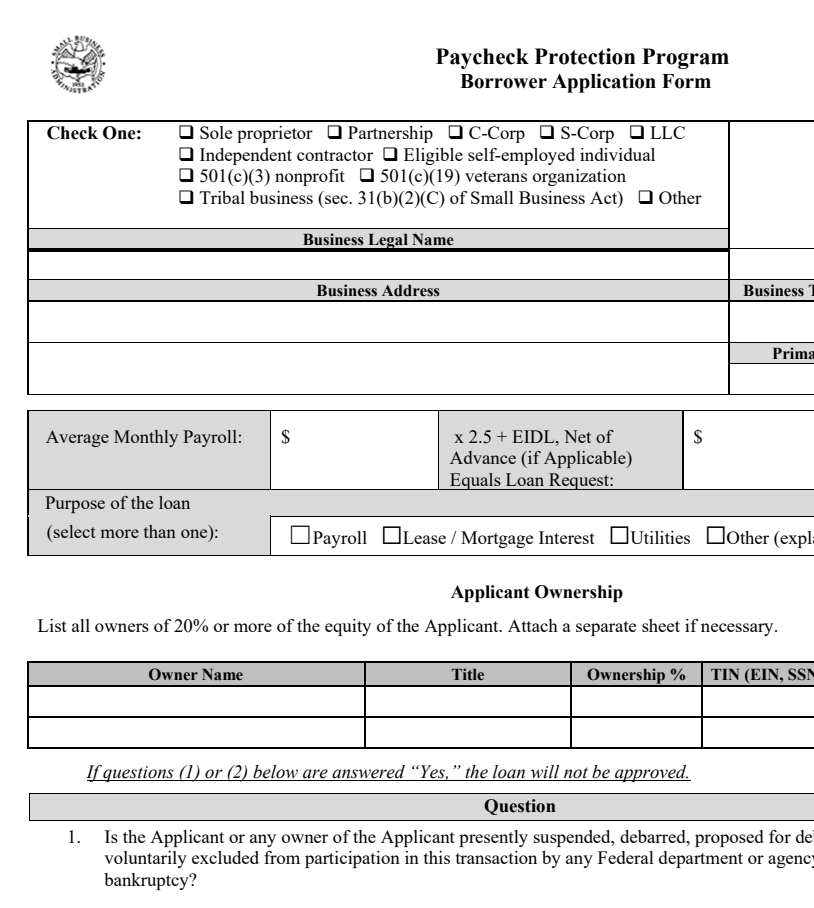

Step 1: Fill Out Quick Form. Section I – Business Information. For example, payroll could be covered with both options, but you have to choose one or the other. Content updated daily for pay rol. Lenders may differ in the payroll documentation that they require.

However the AICPA has made recommendations for the documents to be prepared and submitted with the application. What about Economic Injury Disaster Loans (EIDL) loans?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.