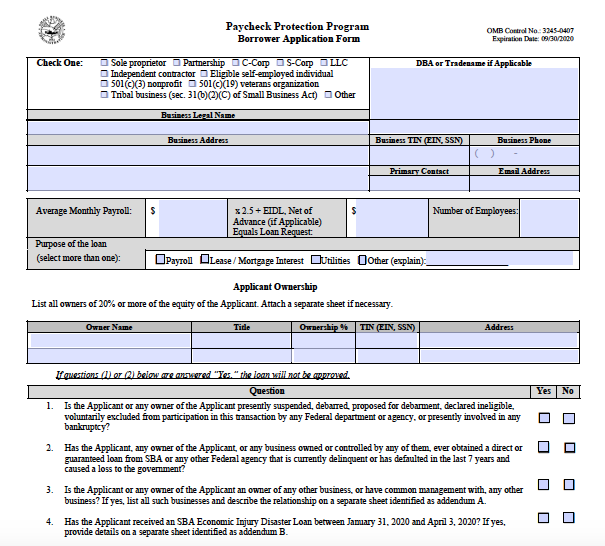

Submission of the requested information is required to make a determination regarding eligibility for financial assistance. Failure to submit the information would affect that determination. A form to be filled out by the authorized representative of the borrower. Other articles from investopedia.

Paycheck Protection Program EZ Loan Forgiveness Application Paycheck Protection Program EZ Loan Forgiveness Application. What is paycheck protection legislation? QuickBooks Capital is not able to process applications from Schedule C filers who have employees, seasonal businesses, or recipients of an EIDL loan between. The new application. It’s part of the 7(a) loan program with the goal of providing low-interest loans with favorable terms to small businesses impacted by the current economic crisis caused by.

Whether you’re waiting on an already submitted application or you. Funds can also be used to pay interest on mortgages, rent, and utilities. Make Your Payroll Effortless and Focus on What really Matters. Get up to 1 of your PPP loan forgiven based on your employee status, payroll and how you used the loan funds. Webster is no longer accepting PPP applications.

You may have heard that Congress is discussing new legislation. Get High Level of Information! If you keep all of your employees, the entirety of the loan will be forgiven.

There is no fee to apply, but you MUST apply through a financial institution. If less than of the loan amount is used on payroll costs, the amount of the loan that is forgiven may be reduced. Borrowers may receive up to $million.

This is the form small businesses who received a PPP loan will submit to their PPP lender when it’s time to have their loan partially or entirely forgiven. Most bank application sites are complete or nearing completion. We recommend that you begin preparing and gathering documentation that will make the process as fast and easy as possible. As a result, if you spend your loan on payroll, rent, mortgage interest, or utilities then the government will forgive your loan so you don’t have to pay it back. After a few days of endless discussion and head pounding attempts to interpret and understand the program , it’s game time.

Get for your search at Answerroot. We offer an online portal where our borrowers can submit the PPP Loan forgiveness application , required documents, and supporting data. We are no longer accepting new applications. Thank you for your interest.

Check the Status of an Application. Initially, this was a $350-billion program providing small businesses with eight weeks of cash-flow assistance through federally guaranteed loans, functioning like a non-taxable grant. How to Calculate Your Loan Amount. Supplemental Information Sheet.

Builders can apply until June 3 but the entire program has $3billion authorized. Below is a summary of the criteria for loans under this program. As an SBA Preferred Lender, we look forward to continuing our support of. This new program is designed to give small businesses the capital they need to support payroll costs and other expenses during the temporary disruption caused by the COVID-pandemic. Small Business Administration.

Begin your PPP loan application through Lendio to be matched with a PPP lender. Lendio is not a lender, and an application submitted through Lendio does not guarantee you will receive a PPP loan or be matched to a lender. We will accept applications throughout the program or until allocated funds for the program have been exhausted.

For accuracy and completeness, consult.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.