One Low Monthly Payment. Powerful and Easy to Use. Get High Level of Information!

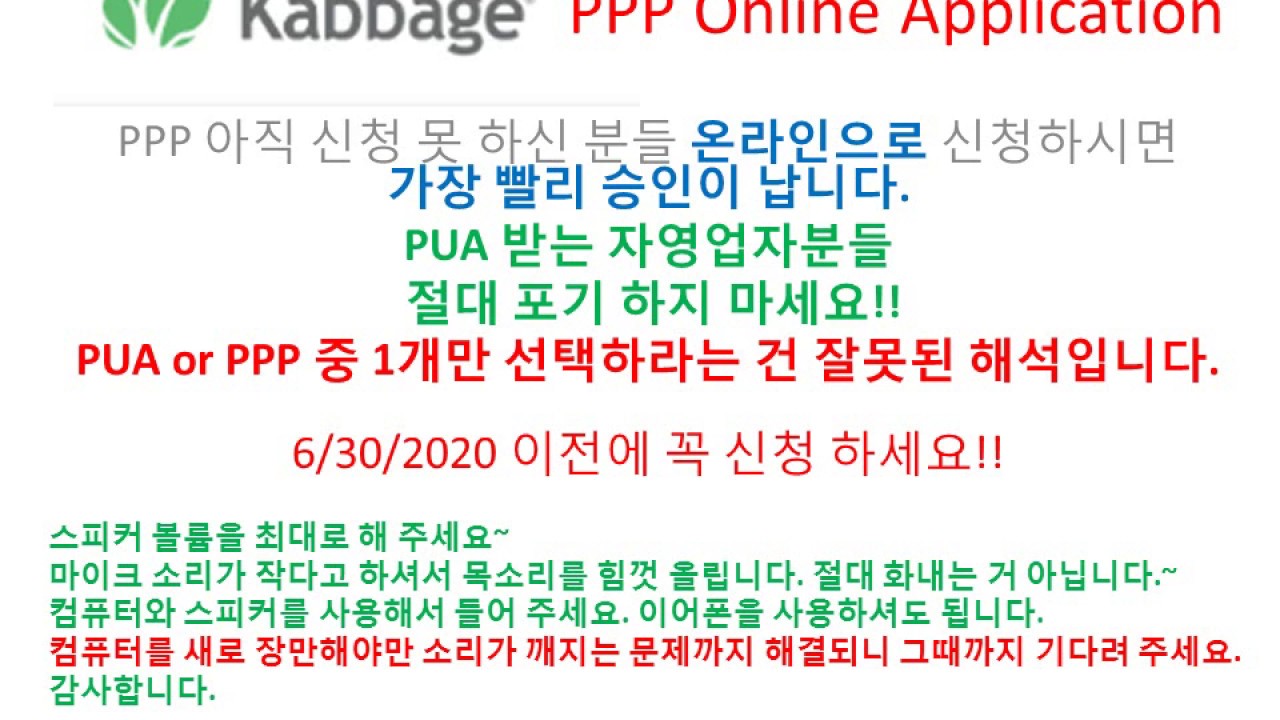

Any reduction in an employee’s salary or hourly wages of more than will be subtracted from your eligible loan forgiveness amount. The SBA is no longer accepting applications for PPP loans. If you received a PPP loan through Kabbage , sign into your dashboard for updates on loan forgiveness. The PPP loan program allows small business owners and self-employed individuals to apply for funds up to 2. These funds cover payroll and other approved business expenses.

If the funds are used appropriately, business owners can apply for full loan forgiveness to have the entire amount of the loan forgiven. At the start of the coronavirus (COVID-19) pandemic, the U. The funds are 1 forgivable if you follow the loan forgiveness requirements carefully. The news comes as Kabbage , just like other fintechs, has been struggling as.

Is Kabbage an authorized SBA lender? Small Business Administration (“SBA”) lenders. Loans are available for up to 2. If employers maintain their payroll and use loan funds for allowed expenses like pay. Is my business eligible?

Program funds are limited. SBA’s size requirements 3. NAICS code beginning with 72) if i. See full list on kabbage. Other regulated lenders will be available to make these loans as soon as they are approved and enrolled in the program. What information do I need to provide to apply? Documents required vary by business type.

Do I need to pledge any collateral for these loans? No collateral is required. Will my PPP loan be forgiven?

Yes, the loan amounts will be forgiven as long as: 1. Employee and compensation levels are maintained. The amount of your loan that is forgiven is equal to the amount you spend during the weeks following loan origination toward eligible expenses, including: 1. Payroll costs (using the same definition of payroll costs used to determine loan eligibility) 2. Interest on the mortgage obligation incurred in the ordinary course of business 3. Rent on a leasing agreement 4. Can the amount forgiven be reduced? The amount of loan forgiveness is reduced if there is a reduction in the number of employees, or a reduction of more than in wages paid to employees. What interest expenses are considered eligible?

What rent expenses are considered eligible? What utility expenses are considered eligible? These unprecedented times have affected small businesses all over the country. How are SBA loans funded?

From cash flow losses to temporary layoffs, small businesses are having to quickly adapt due to the COVID-outbreak. In less than two weeks, Kabbage entirely restructured its lending platform and developed new automated systems to ingest, analyze, verify, and approve PPP applications, distilling a complex and. The company has traditionally served small business with fewer than.

Recommended For You Diginex: The First Crypto And Digital Asset Exchange To Go Public. Kabbage is an online lending partner which doles out small business loans both directly and through partnerships with banking partners. Last week, Kabbage stopped issuing credit to current customers and announced it was putting its full effort into supporting PPP loans for small businesses.

Here we have everything you need.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.