Licensed Surety Experts with Affordable Rates. Now, candidates can fill up the SSB documents well in advance and save the time during SSB interview documents c. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or. How do indemnity bonds work? What is bond of indemnity?

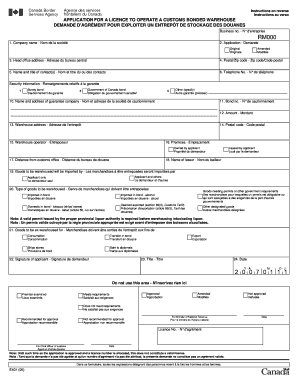

Who should sign an indemnity bond? How is indemnity bond executed? The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

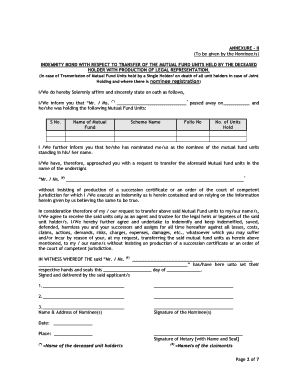

Affidavit should be verified in presence of a First Class Magistrate or a Notary Public. Personal Information. A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity. Indemnity bond defines under section 1of the Indian Contract Act.

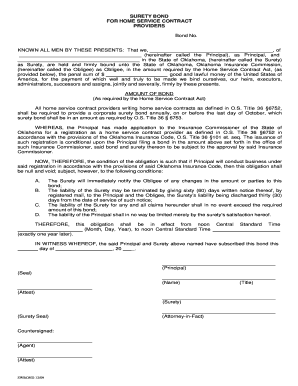

A North Carolina indemnity bond , or title bond is a mechanism available to motor vehicle and mobile home owners that have lost a title or possess a defective title. Not all vehicles are bondable. Per the North Carolina Department of Motor Vehicles , the indemnity bond options is not available to the following: Abandoned vehicles. Bond of Indemnity Overview.

The bond of indemnity definition is an obligation in writing in which a party has agreed to reimburse the holder of the bond for an injury or loss due to a specific event or has agreed to protect a party from injury or loss related to a specific event. Forms like PIQ form, Identification form, certificate of previous candidature, risk certificate, travelling allowance form, certificate for final and pre final candidates etc. Three Reasons to Choose Fixed Income. and Learn How to Diversify. In cases where it appears necessary to protect the annuitant, the service secretary concerned may require the payee to provide a surety bond in an amount sufficient to protect the interest of the.

Letter of Consent-Cum-Relinquishment for claims up to Rs. Street herein after called the Indemnifier which expression shall mean and include executors, administrators, heirs, successors, and assigns to and in favour of Eastern Power Distribution Company of A. Requirements for Indemnity Bonds Please complete this entire form and be sure the areas listed below are filled in as required to avoid making any corrections later. In consideration of the execution of said bond and any modification thereof, or additional bonds , the Undersigned hereby undertake and agree: 1. To pay the Surety in advance such premium as the Surety shall charge, while said bond remains in force. I am very sure that after watching this video your all doubts. A lost instrument bond belongs to the miscellaneous class of commercial surety bonds.

The bond must be for one and one-half (1½) times the value of the vehicle as shown in the Value Schedule provided by the Division and must be for a minimum of $100. There are usually three parties to an indemnity bond : the principal (the person who will receive the money in the case of a breach), the obligor (the person who purchases the indemnity bond as security for performance) and a third-party guarantor, usually a. Great job with the bond quick and easy. Fifty thousand only) with one sure ty acceptable to the Employer Bank. NOW THIS INDENTURE WITNESSED as unde r: 1. Below is a sample of page and page with highlighting of the areas that you will need to complete on the form.

India and having its registered office at _____ _____ registered dealers under the Central Sales Tax Act. SSB :- participants each will be selected by SSB from Ranchi and Dumka district of Jharkhand and tribal youth participants will be selected by SSB from Jamui district and tribal youth participants from Gaya districts of Bihar State with filled in application of the selected candidates along with filed in Indemnity Bond. A copy of the latest bill and also with receipt of the bill.

An indemnity bond copy. Professional and extremely competent. Series EE, Series E, and Series I bonds may earn interest beyond their original maturity date. Age of the Guarantor 5. Name of the father of the Guarantor 3. We all the parties read over this bond and agreed to all the terms and conditions and put our signature and also the left hand thumb impressions in all the pages in this bond in presence of the witnesses on the above said place, date, month the year.

A security bond is a binding pledge to pay the government if either you or your worker breaks the law or Work Permit conditions. The bond is in the form of a banker’s or insurer’s guarantee. You must buy a $0security bond for each non-Malaysian Work Permit holder you employ.

You cannot ask your worker to pay for the bond.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.