Calamity loan sss form - Fill Out and Sign Printable PDF. How do I apply for SSS loan online? Where can I get SSS application form? How long does it take to get a SSS loan?

The advanced tools of the editor will lead you through the editable PDF template. Enter your official contact and identification. First things first, you need to know if you’re eligible for an SSS salary loan. You must fall under all of the following criteria to be eligible for the SSS salary loan: 1. You must be a currently employe self-employed or voluntary member.

Your employer, if any, must be updated in the payment of contributions. You must not be more than years old at the time of application. You must have not been granted final benefits, such as death, retirement or total permanent disability. For personal loan applications at the SSS office, you should provide two valid IDs.

But since you will be applying for the SSS loan online, there’s no need to present. See full list on techpilipinas. Nowadays, you can apply for an SSS salary loan using your computer or mobile device, and you don’t need to submit documents and IDs to SSS when doing so.

To apply for an SSS salary loan online, make sure that you have a My. If you don’t have a My. SSS account yet, go here to. Only current SSS members can register for My. The SSS salary loan is payable within two yearsin monthly installments.

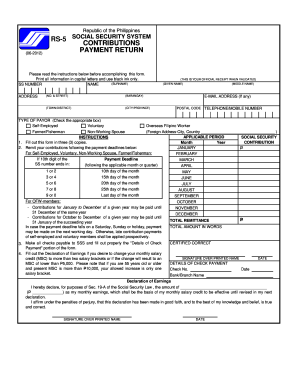

A complete breakdown of your payables can be found in the Disclosure Statement. The loan amortization starts in the second month after the date of the loan approval. The payment due date or deadline will be on the last day of the month following the applicable month. If the payment deadline is a Saturday, Sunday or holiday, you can pay on the next working day.

You can pay your amortizations at any SSS office, SSS -accredited bank, authorized payment center, or online payment servicelike GCash. Member-borrowers must use their payment reference numbers (PRN) when paying. SSS charges an interest of per annum (year) based on the diminishing principal balance, until your loan is fully paid. In addition, there is a service fee which will be deducted from the loan amount.

Any excess payments will be applied to the outstanding principal balance, which means that you can pay your loan in advance. As a member-borrower, it’s your obligation to pay your dues on time. But sometimes life gets in the way and you might fail to repay your loan.

Don’t worry though because SSS has contingency measures in place in case of loan default. A loan default happens if you fail to pay your amortizations for more than months. If that happens, the full balance of your defaulted loan will become due. For self-employed and voluntary members, the unpaid loan will be deducted from his or her short-term benefits such as sickness, maternity or disability benefits.

If the member-borrower dies, becomes disable or retires, the unpaid loan including interests and penalties will be deducted from the corresponding benefit (death, disability or retirement). You can then use the loan to pay debts or even start a new business. It’s not much but it certainly helps in difficult times.

Be sure to repay the loan on time to avoid any penalties and the possibility of defaulting on your loan. For more information about the SSS salary loan, visit the SSS website. In your dashboar hover over the “e-services” tab.

It will show you a loan application form. E-Services menu function. Qualifications for the Loan Application Members who are qualified for this loan are those who have paid contributions for months and six months of these should have been made within the last months before the loan application is submitted.

Fund Retirement Benefit Claim ForSSS P. UPDATED) Step 1: Access the SSS Website. Step 2: Select one information to register to My. Make sure it’s the same information that you used when you applied as a member of SSS.

Step 3: Fill out the SSS Online registration form. Tips in Filling out the SSS. Search For Online Loan. Everything You Need To Know. Powerful and Easy to Use. TopHelp You. Create A Comprehensive Loan Agreement Online.

Aside from these benefits, you can also avail of an SSS salary loan. You can use the loan for your personal needs, business purposes, or for any reason you see fit. The good news is that you can now apply for an SSS salary loan through the Internet.

Fill - up the application form correctly to have a hassle-free transaction and bring the original copies of the requirements needed. Note: There is a portion in the loan application form which the school needs to fill up and sign. Click the Terms and Conditions agreement tick box then Proceed. Right now, the SSS is offering SSS Loan Restructuring Program (LRP) for delinquent member-borrowers to regain their good SSS standing and enjoy SSS benefits and privileges in the future.

This is by cleaning up their overdue loan principal and interest in full or by installment under a restructured term depending on their capacity. Sana makatulong sa inyo ito lalo na at nasa crisis ang buong bansa. FOR INQUIRIES AND CLARIFICATION YOU CAN CONTACT THEM at the nearest SSS branch SSS Call C. By definition, the sickness benefit is a daily cash allowance paid by SSS for the number of days a qualified member is unable to work due to sickness or injury.

SSS Online Employer Registration Steps Now that you have registered to SSS as an employer and have gotten your employer ID.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.