Build Custom Release Forms For any Purpose - Organize Important Forms Today! Do I really need a hold harmless agreement? What does “hold harmless” mean? Are hold harmless agreements legally binding? Should you ever sign a hold harmless agreement at closing?

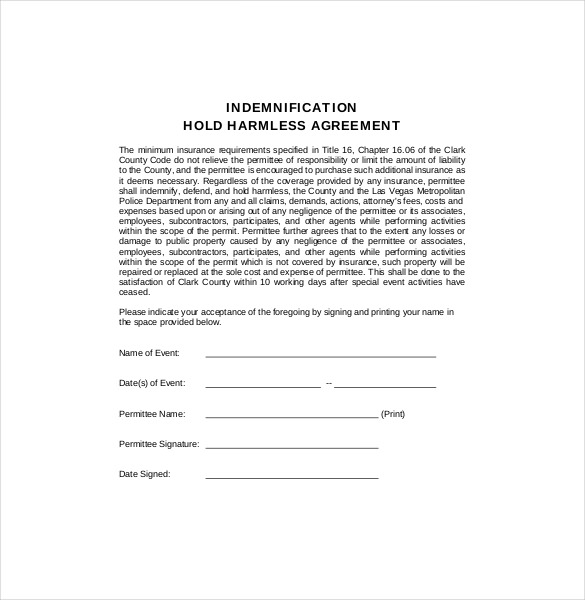

A provision in a contract that requires one contracting party to respond to certain legal liabilities of the other party. A hold harmless agreement is a provision in a contract that requires one contracting party to respond to certain legal liabilities of the other party. For example, a hold harmless agreement in construction contract typically requires the contractor to indemnify the owner with respect to the owner’s liability to members of the public who are injured or whose property is damaged during the course of the contractor’s operations. Hold Harmless Agreement —. Since a hold harmless agreement is a contract , your insurer might not cover any losses that result from you signing it. General liability policies also have other exclusions for things such as worker’s compensation claims or architectural design errors.

The second party assumes the legal responsibility for damage or injury. In signing such a clause, the other party accepts responsibility for certain risks involved in. Outside of the personal injury context, a hold-harmless agreement in title insurance is when a title company agrees to indemnify another title insurance company that is preparing to insure a transaction that the indemnifying title company has previously insured over without taking an exception to its title insurance policy for matters remaining of record.

Use On Any Device With Unlimited Access! Fill Out An Easy Questionnaire. Register and Subscribe now to work with legal documents online. However, insurance is often used in conjunction with a hold harmless agreement so that you have several layers of protection. In some circumstances, the person or entity that is supposed to be relieved of liability may not be “held harmless ” because the other party lacks the funds or resources to deal with their obligation under the contract.

This hold harmless agreement sample can be used in situations where an insurance policy has been taken and terms of the policy as to where it is applicable and where not are to be stated. Insurance companies for a defendant in a personal injury case will sometimes ask for some type of hold harmless agreement (or letter) to give them formal assurance that the plaintiff and their attorneys will resolve any medical liens and that they will not be responsible for liens that are not resolved. Here are some professional-grade samples of hold harmless contracts used in a variety of situations, provided as PDF and Word document files. Feel free to download them at no cost as a point of reference or as templates in drafting a similar contract. Another Party Liable for Risk.

Liabilities, Claims, or Damages. Comprehensive, Immediate Use. Print, Save, Download 1 Free! Secure Cloud Storage. No Installation Required.

Or worse still, insurance agents or brokers are asked (or volunteer) to draft or supply an indemnity or hold harmless agreement to its customers. While having a working understanding and the role of such agreements is of value, recognize that such advising or drafting of indemnity and hold harmless agreements is the practice of law. In exchange for this promise, the other party agrees to permit the first party to engage in a given activity. To make matters worse, ISO keeps rewording the coverage forms in ways that the average insurance agent finds arcane and mystifying. Create Your Free Account!

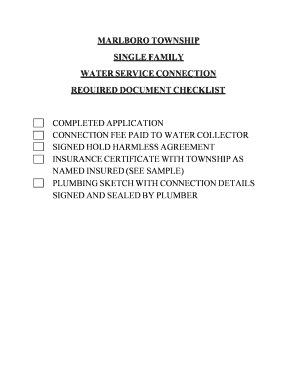

The Certificate of Insurance shall list the deductible as well as the type of policy purchased (i.e. claims made or per occurrence) for each of the policies listed below. Get Started 1 Free! A waiver of subrogation causes one to give up the right to allow an insurance company to step into the position of the contractual party to recover damages.

The insurance outlined above shall be written by companies admitted to do business in the State of Iowa, and acceptable to the District. Developed by Lawyers, Customized by You. Answer Simple Questions to Generate Your Documents Today - 1 Free!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.