Do you have to provide paid sick leave to work in Washington State? What are the sick leave laws in Washington? Is sick leave mandatory in Washington State? How long does Washington workers get paid? Enforcement of paid sick leave laws.

If you are an employee in Washington State, your employer is now required to provide you with paid sick leave. Your right to paid sick leave. Most employees who work in Washington State have the right to earn paid sick leave under the law. If eligible, you will earn one hour of sick leave for every hours worked. There is no cap on the amount of sick leave you can accrue in one year using this 40:formula.

Washington state law requires employers to provide paid sick leave to their employees. It also sets the minimum requirements for an employer’s paid sick leave policy. You may not need a written paid sick leave policy, but having one is highly recommended. If you have a written policy, it must be readily available to all of your employees.

Qualifying employees can take weeks (or in some situations) of paid sick leave without fear of losing their jobs. Employees are entitled to at least hour of paid sick leave for every hours worked. Employers may also provide paid sick leave in advance of accrual provided the front-loading meets or exceeds the law’s accrual, use, and carryover requirements.

The law applies to almost all employers, regardless of size. You don’t have to use your leave all at once. For example, you can take one day off a week to care for a family member receiving chemotherapy treatment. Paid Family and Medical Leave is a new benefit for Washington workers. It’s here for you when a serious health condition prevents you from working or when you need time to care for a family member, bond with a new child or spend time with a family member preparing for military service overseas.

Employees who designate leave as supplemental will receive full vacation leave , sick leave , personal holiday or compensatory time pay in addition to any PFML wage replacement benefit received. State HR will be adopting administrative rules related to supplemental benefits in the near future. Please be sure to review those as well. Here’s what you need to know: 1. This includes agricultural workers, seasonal workers, and workers here under an H2-A. You cannot be disciplined in any way for using sick time.

Taking sick time cannot be counted against you, even if your employer uses an “occurrence” system. It doesn’t matter if your employer is large or small, or if you work part-time or seasonally: if you are an employee in Washington State , you get paid sick time. How the Emergency Paid Sick Leave Act applies to state employees. An employer must provide an employee with paid sick leave if the employee is unable to work or telework because: The employee is subject to a federal, state or local isolation or quarantine order due to COVID-19. Also, the for maximum hours is incorrect.

An employee in Washington does not have a cap on hours earned in a year. Generally, paid sick leave laws by state specify information like accrued time off rates, maximum accrual limits, and which employers must follow the law. During this time, your life may be disrupted in a variety of ways. The state has taken action to prevent the spread of COVID-by prohibiting people from gathering, whether at school, work , or other settings.

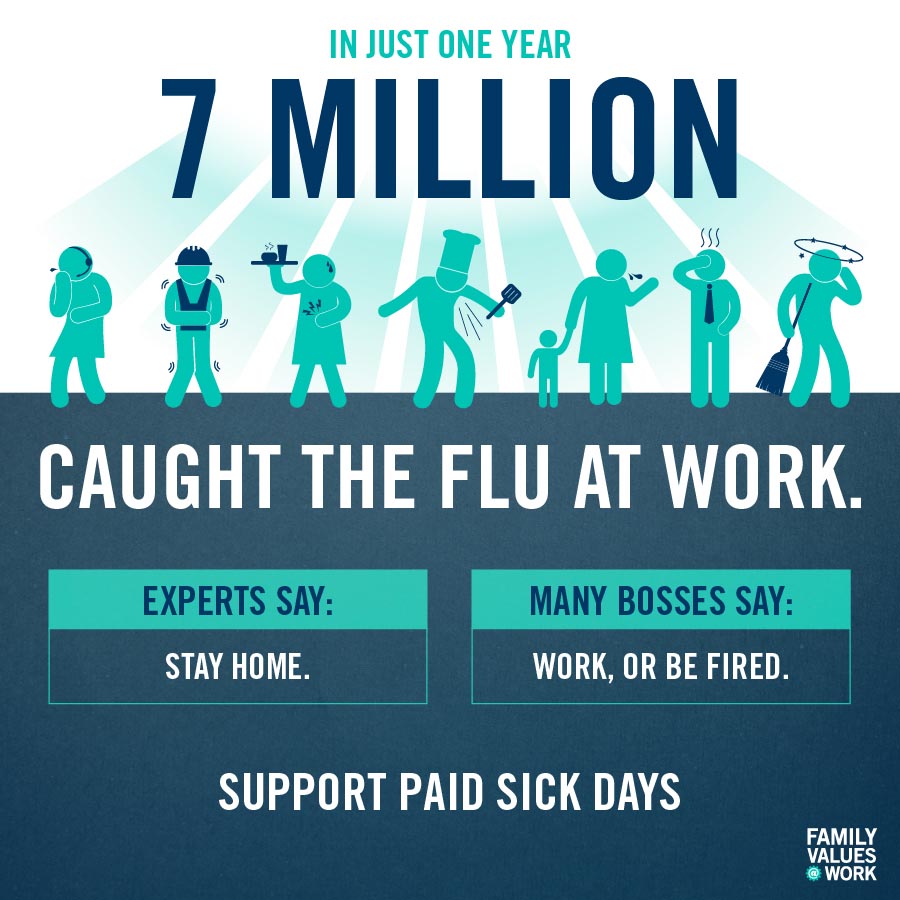

However, hourly employees and salaried managers who supervise more than two employees, may be exempt, as are professional staff such as doctors, lawyers, and dentists. Tell sick employees to stay home: Make sure your sick leave policies are flexible and consistent with public health guidance and that employees are aware of these policies. Talk with companies who provide contract or temporary employees about the importance of sick employees staying home. The first and best option for employees who need to miss work due to COVID-is to use their employer-paid time off because this can pay 1 of wages. Labor and Industries has information about Paid Sick Leave.

The Emergency Paid Sick Leave Act limits an employer’s requirement for paid leave to $5per day (or $1in the aggregate) where leave is taken under the first, secon and third reasons noted above, and $2per day ($0in the aggregate) where leave is taken under the fourth, fifth, and sixth reasons, as noted above. If you worked in Washington and another state (s) in the past two years, you might get more money if you apply for benefits by combining wages you earned in Washington with wages from another state (s). You must have wages in Washington in order to file a combined wage claim against Washington.

If you collect unemployment benefits from Washington.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.