Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Collect Legally Binding Signatures. Digitally Sign Sample Documents. Use Form 9-V when making any payment with Form 944.

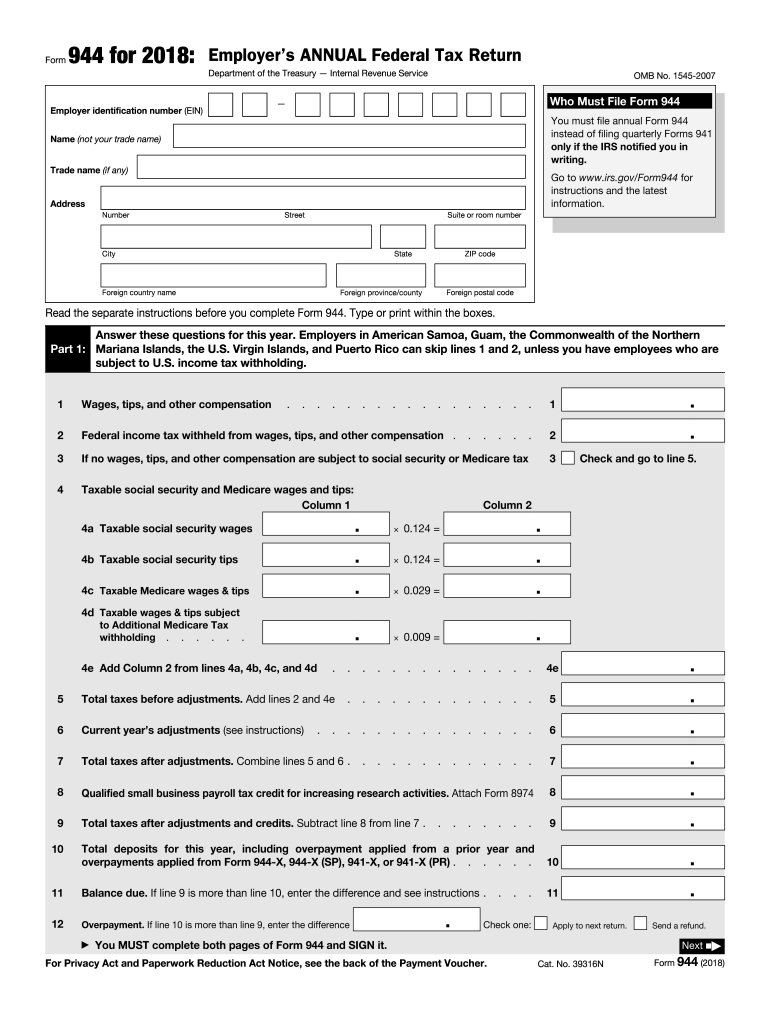

However, if you pay an amount with Form 9that should’ve been deposite you may be subject to a penalty. See section of Pub. The form instructions for Form I- 9require the applicant to report and submit information about whether the alien applied for, was certified or approved to receive, or received certain non-cash public benefits on or after Oct. In this Part, you will be providing information about your assets, resources, and financial status, as well as the assets, resources, and financial status of all other household members. The form was introduced by the IRS to give smaller employers a break in filing and paying federal income tax withheld from employees, as well Social Security and Medicare payments owed by employers and employees.

Other articles from thebalancesmb. For more information, see the Instructions for Form 9-X. Employers can request to file Forms 94 941-SS, or. What is 9form used for? When do I file Form 944?

Where to file 9form? Enter the name of the city or town, and country where you were born. Type or print the name of the country as it was named when you were born, even if the country’s name has changed or the country no longer exists. Some small employers are eligible to file an annual Form 9PDF instead of quarterly returns.

If an organization is not exempt from unemployment taxes, it must file Form 9PDF annually. The tax-exempt organization must also furnish a copy of Form W-PDF, Wage and Tax. Fill Out Your Form In Minutes With Our Template Builder. Form I- 9, Declaration of Self-Sufficiency, is used by an individual to demonstrate that he or she is not inadmissible based on the public charge ground (Immigration and Nationality Act (INA) section 212(a)(4)). On IRS Form 9, you need to enter information about employee wages to make sure the amount you withheld is correct.

In order to complete Form 9, you must enter your EIN, business name, trade name (if applicable), and address. Form 9is for annual reporting, not for quarterly reporting. Form 9was intended to give small business employers a break when it comes to filing and paying federal payroll taxes. Here’s why small businesses may benefit from using Form 9: reporting and paying employment taxes may take a considerable amount of time, and small businesses.

Like Form 94 it’s used to report your employer and employee Social Security and Medicare taxes, plus employee federal income tax payments. Adjustment of Status procedure, is required to. The instructions itself are pages. For all the supporting documents, you should submit photocopies that are readable, unless they ask for originals for review.

This form requires a lot of financial, family, and health information and therefore requires a lot of documents. Thus, the I- 9is now a critical piece of evidence in deciding whether an applicant for adjustment of status is inadmissible based on the public charge ground. This practice advisory is the first of a two-part series on the new Form I- 944.

This advisory covers who needs to submit the I- 9and tips and strategies for completing the application. Only the smallest employers can file Form 944. Submit Form 9to the IRS even if you don’t have taxes to report, unless you filed a. How Do I Qualify for a 9? In order to qualify for the tax status of being able to fill out Form 9, you must receive written notification.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.