Search Irs 9Online Filing. You can e- file any of the following employment tax forms: 94 9, 94 9and 945. Benefits to e- filing : It saves you time. How to electronically file 941?

Can I file 9on my own? Don’t forget that our website grants you the possibility to access the 9printable template, as well as fill out the form online with ease. Electronic Payment Options: Convenient, safe and secure methods for paying taxes. Department of the Treasury. If you have a balance due.

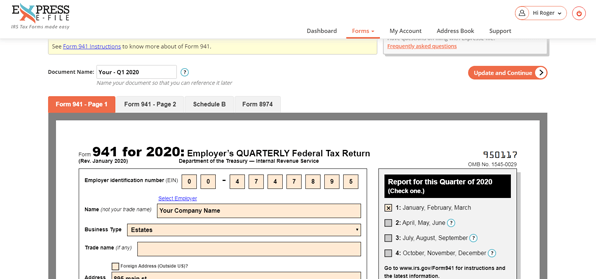

IRS authorized e- File service provider for Payroll Tax form 941. However, the form cannot be e-filed by your business. A payroll service provider that is approved for e- filing.

The IRS requires that all businesses electronically file form 9through an approved intermediary. Select the Payroll tab, the File forms. Click Change Filing Method at the bottom under the Other Activities section. Follow the instructions on the MyTax Illinois screens and enter your tax information.

Amended returns can be filed electronically for current year returns only. A separate filing is not required. Check out essential info on Finecomb. File 9online in simple 1-2-steps.

Efile 9for just $3. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

If taxpayers do not wish for the e- file providers to sign the form, the taxpayers can opt to choose an e- file provider who allows them to sign the return with a PIN or provide a PIN to the provider to sign on his behalf. A detailed transaction summary is available. Delinquent returns can be filed. Prepare your quarterly return from any device without installing any software.

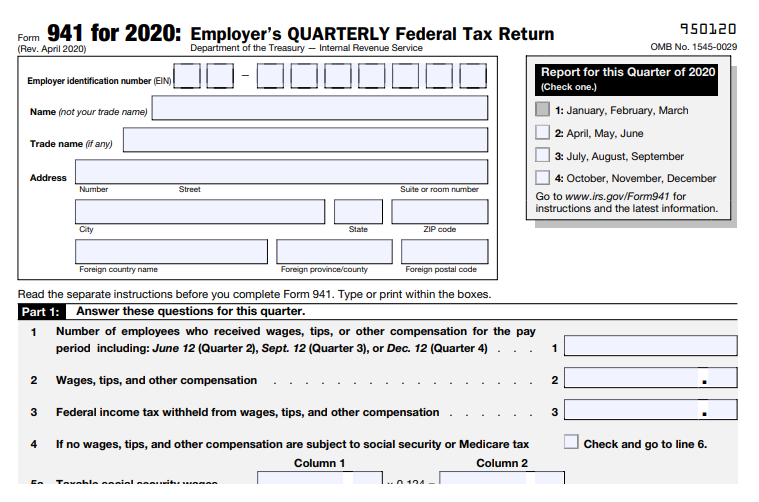

Since you must file a separate form for each quarter, the IRS imposes four filing deadlines that you must adhere to. The deadlines are April 3 July 3 Oct. Just remember that the filing deadline always falls on the last day of the month following the end of the quarter.

Returns via mail must be addressed correctly, have enough postage and be postmarked by the U. Postal Service on (or before) the due date. See above for due dates. Send returns send by U. Postal Service to one of these listed addresses (varies based on state).

E- file 94 9, and 9tax forms. E- file W-and W-in QuickBooks Desktop. Form 9filing deadlines. Note: Payments and filings are not submitted automatically, you must submit forms and payments.

TSC Online Businesses and Bulk Filers who file , pay, and manage the tax types listed below can now create their myconneCT username and begin using myconneCT ! Prevent new tax liens from being imposed on you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.