Aliens are classified as nonresident aliens and resident aliens. Resident aliens generally are taxed on their worldwide income, the same as U. What is the federal tax system? The highest tax bracket for individuals in the US is (it ranges from to ) and for corporations the tax rate is.

Stated another way, students are in a better position to appreciate how the tax system can sometimes be used to generate (or combat) unfair and economically inefficient rent-seeking behavior. Words, 7pages in PDF. Individual Income Tax Return U. There are several types of taxes: income, sales, capital gains, etc.

Federal and state taxes are completely separate and each has its own authority to charge taxes. The federal government doesn’t have the right to interfere with state taxation. IRS Use Only—Do not write or staple in this space.

Filing Status Check only one box. Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of spouse. The State of State (and Local) Tax PolicyKey Elements of the U. A guide to the key U. Other state tax issues. Before actually paying this tax , however, the corporation could claim a foreign tax credit of $2 reducing its U. Notice that this corporation pays a total of $in taxes worldwide, corresponding to a world tax rate on foreign earned income.

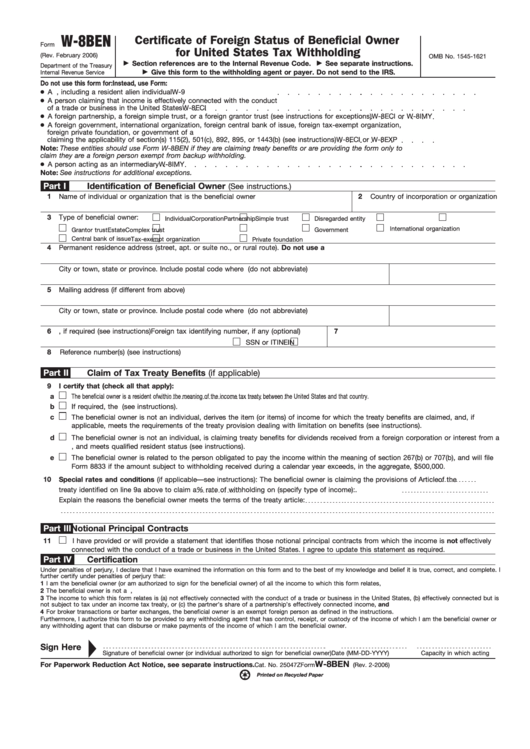

Americans abroad – – Chapter – Taxation of foreign earnings and the foreign earned income exclusion If you are a U. United States, you may qualify to exclude some or all of your foreign earned income from U. Tax Withholding Brokerage firms located in the United States are required to with-hold U. Dividends:Generally,dividendspaidonstockissuedbyU. Comprehensiveness rating: see less. It focuses on the theory behind tax laws and does not cover the actual issues that tax attorneys or paralegals need to address on behalf of their clients. Tax Code was written with an implicit understanding that wealthy individuals would engage in tax planning in order to minimize taxes.

This book needs editing. These marginal income tax rates are applied against taxable income to arrive at a taxpayer’s gross income tax liability. Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Courtroom Deputy Clerk to tax allowable costs in a civil action as part of a judgment or decree.

However, many countries, such as the U. Germany, have adopted partnership forms that combine the benefits of limited liability with a “pass-through” tax regime. A good example of this use of excise taxes is the gasoline excise tax. Governments use the revenue from this tax to build and maintain highways, bridges, and mass transit systems. Treating Your Nonresident Alien Spouse As A U. How To Make The Choice 17.

Ending The Choice 17. Citizen With A Foreign Spouse 17. Transfers Or Gifts To Nonresident Alien Spouse 18. It is the taxation of U. For tax purposes, a corporation is a separate from its“taxpayer” shareholders, meaning that the corporate entity is subject to taxation on corporate-level events. Section of the Internal Revenue Code (Code) lists the progressive rates of tax on corporations.

The withholding tax usually in a much greater U. Find to top questions about filing federal income tax , paying, getting refunds, and more. Get information on federal, state, local, and small business taxes, including forms, deadlines, and help filing.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.