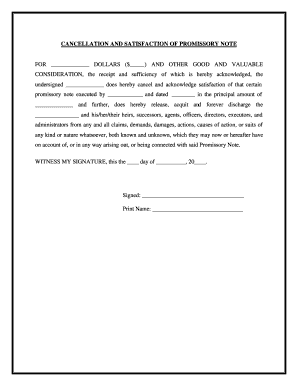

What is release of debt? A Promissory Note Release Form is a legally binding way of proving when a debt has been paid off, whether between two private individuals or involving a business. Just as its name suggests, this form “releases” the promissory note, or loan, which essentially makes it a receipt for the borrower. This request usually is from the debtor, after final payment, in order to get a receipt from the creditor and be able to show a. Debt Release Letter – After a debt has been paid this acts as a receipt.

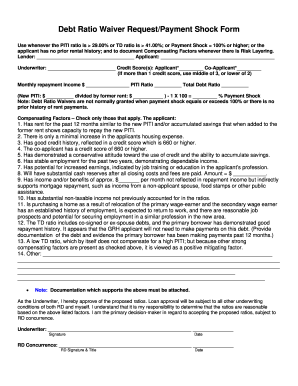

This is usually to create a new payment plan. Debt Settlement Offer Letter – Use when making an offer to compromise on a debt owed. RELEASE OF LOAN AGREEMENT.

In consideration of full payment by _____ (the Borrower), of _____, of the debt evidenced by the Loan Agreement dated _____, which sets out terms for repayment of a loan of $ _____ (_____ dollars) plus any accrued interest (the Agreement), I, the undersigned Lender, _____ (the Lender), of _____, for ourselves and our personal representatives, executors. Settle disputes out of court and release one or both parties from liability with a free Release of Liability Agreement. Available to print or download in all states. A Release Agreement, also sometimes called a Release Form or a Waiver, is a document that is used when one party needs to release the other from liability - in other words, Release Agreements are normally signed after there has been some sort of incident that damages one party (the damage can be physical or financial or other damage) and the party would like to release the other party from.

Types of Release of Liability Forms General Release Form. General Release forms are mostly used when an individual is generally renouncing all unknown and known claims against another person. This form can cover general claims that are often filed in most dispute cases. A general release is detailed and flexible enough to handle many situations. This deed is made and the said property is conveyed by the Grantor for the sole purpose of releasing the above described property from the lien and title of certain Deed to Secure Debt from _____ to _____ dated _____ securing payment of $ _____ and recorded in Deed Book _____, page _____, _____ in the office of the Clerk of Superior Court of.

Get Standard Liability Release Waivers Stress Free. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Over 1M Form s Created - Try Free! Comprehensive - Start Now! Certain individuals may need to complete only a few lines on Form 982.

For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt ) or a loan for the purchase of your principal residence, follow the chart, later, to see which lines you need to complete. In the example, the form is intended to be used by students of an educational institution who have outstanding school debts ranging from the books that they are. A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts.

In other words, the debtor is no longer legally required to pay any debts that are discharged. These are most often used by GSA employees, contractors and customers. If a waiver is granted in full or part, you will not be required to pay the amount that was waived.

How to Release Your Liability on a Vehicle. NOTE: Be sure to submit your release of liability before canceling your car insurance as you could face legal proceedings under certain circumstances. Depending on your state of residence, you may be able to submit a release of liability form (i.e., “notice of sale) in the following ways: Online. Instantly Find and Download Legal Form s Drafted by Attorneys for Your State. If the debtor fails to make timely payment, then the total amount of the debt becomes due.

Understanding the Lien Release Form. The lien is the conditional rights a borrower has on a property, until the debt is completely paid off. The lien release form is issued after the whole debt is paid.

There are versions of the lien release in terms of further obligations. Both agree that the loan is a debt owed by the Borrower and will be paid to the Lender. Interest shall accumulate on the unpaid balance of the loan at a rate of _____ APR and compounded monthly.

Please note: The Bureau of the Fiscal Service website has a limited selection of commonly-requested forms. You can also check these sources for government forms. GOV FORMS LIBRARY Frequently Requested Forms. Employee’s Withholding Certificate for Local Taxes City or.

Administrative Wage Garnishment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.