Hundreds Of Fillable Forms At Your Fingertips. Secure Cloud Storage. Print Start For Free! How do I create a loan agreement? When to sign loan agreement?

Loan Agreement Letter , Loan Agreement Letter Template. It must have a polite and courteous tone, providing the parties with all the necessary information about the remaining formalities that may need to be completed as well as conditions about the payment of the loan. What is a formal loan agreement? These headaches can follow you even if you write a letter but write it inappropriately.

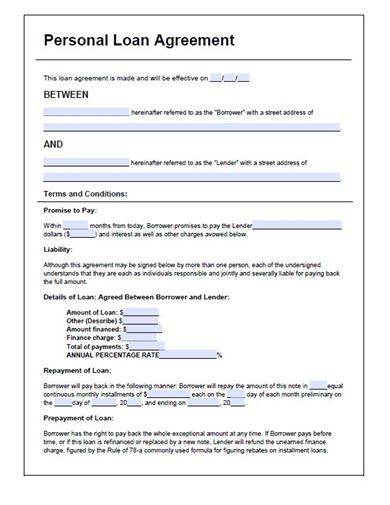

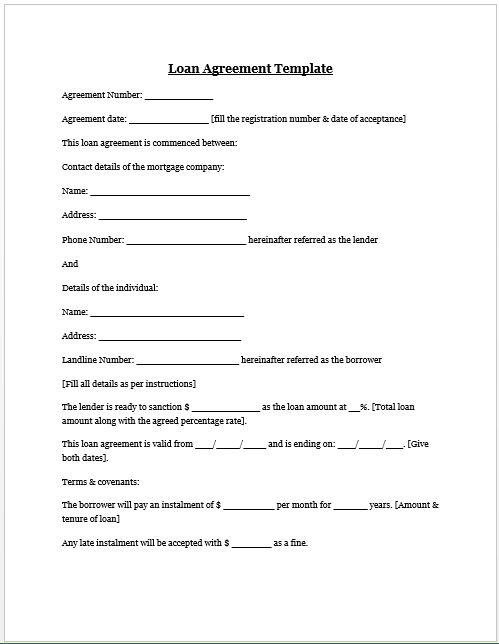

A loan agreement is a written agreement between a lender and a borrower. The borrower promises to pay back the loan in line with a repayment schedule (regular payments or a lump sum). As a lender, this document is very useful as it legally enforces the borrower to repay the loan.

Approaching someone for monetary help is a daunting task. However, you can make it easier if you endure an agreement for loan payment that contains apparent information about loan. The agreement spells out clear.

A loancontract: This is when other parties including the employer if the borroweris involved in paying the loan. The contract lasts for a specified period oftime. Promise to Payor Promissory Note. This comes up in cases of personal loans where family,friends and acquaintances are involved.

People borrow money for various reasons, indifferent conditions and from different types of people or institutions aswell. See full list on wordtemplatesonline. For these reasons, to satisfy the needs of the different types ofborrowers, there exists different types of loan agreements. Onemight wonder why people should sign forms in such cases, yet this is a familymatter.

There are families that are purely legal and official in everythi. Here aresome of the reasons why loan agreements are written. Borrowing money from or lending to family andacquaintances requires agreements to avoid bridging of trust.

Borrowing from or lending money to companies orbusinesses requires an agreement for legal purposes and clarity of theconditions in case of changes in management , changes in business plans amongother reaso. Theinformation on their official names, nationalities, physical postal addresses,gender, age and dependents are given. This is important for location and followup when need arises. Acceleration _These are details which gives the lender protection from defaulting.

Here thedetails of the payment mode, the inte. It is not a sign of mistrust in manycircumstances but at the same time being safe is better than being sorry. Theseagreements benefit both the borrower and the lender. Loan agreements serves many purposes ranging fromtrust to formality and legal requirements. Without a clear method ofpaying back, the loans might be defaulte or the lender may take advantage ofthe borrower and have all their assets confiscated.

Several reasons could propel you toseek a loan agreement of which all will be associated with either borrowing orfully paying a loan. Here are some detailed ideas on why you would require aloan agreement. Helping people close to someone feels good since itis a moral responsibility. Charging interest on friends, colleagues or familymembers might be hard but at the same time, money stays intact when constantlygrown. One way of growing money is through lending at an interest.

Of at all, ifyou want to continue helping, then interest will be important. In doing so youshould consider looking at the stipulated laws governing interests to avoidpain and conflict. A personal loan agreement template is a document that anyone can use to protect themselves as a lender. Filling out a simple loan agreement ensures that there is no confusion between the lender and the person in need of funds. A loan contract template takes the difficulty out of designing a concise and precise document.

Tammy Smith and I both agree that the loan will be repaid using a series of scheduled financial payments. I, Sarah Brown, will submit a monthly payment due on the 1st of every month using a personal check in the amount of $104. The Loan Will Be Accumulating An Interest Based On The Loan Amount Starting One Year From The Date Of This Agreement. The Maximum Term Of Loan Is Four Years. Loan Contracts are typically used for more complex payment arrangements.

Get Reliable Legal Forms Online.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.