How to create a payroll report for PPP loan forgiveness. What is PPP used for? Payment of cash tips or equivalent. Paid parental, family, medical, or sick leave not.

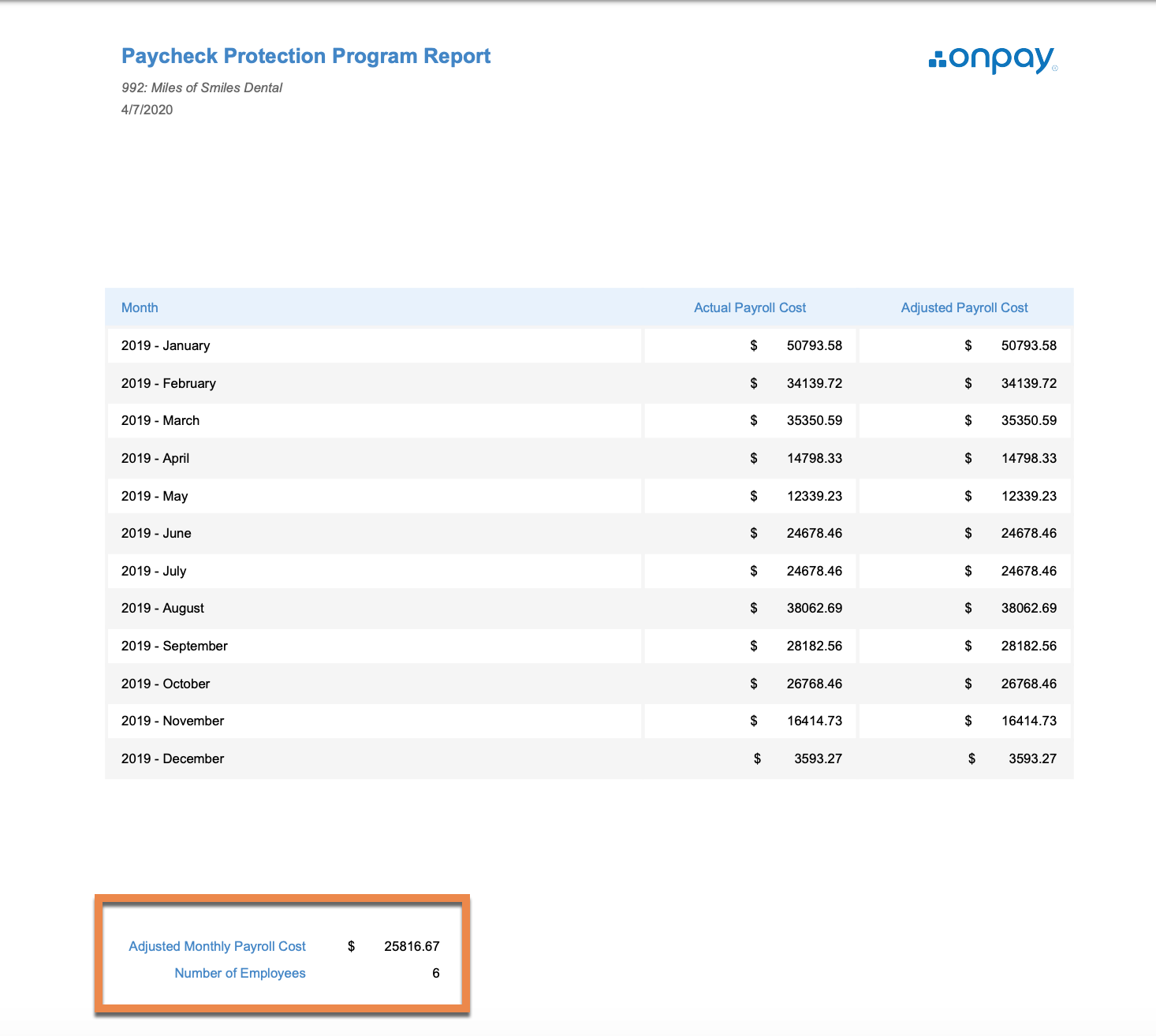

Our PPP report automatically excludes wages over $100on an annualized basis for each employee. The PPP Flex Act extends the availability of loans under the Paycheck Protection Program ( PPP ) and. Select the applicable client or clients , the CARES ACT SBA-PPP Report , and the period for which you would like to run the report.

However, you can change the time period covered by the report by resetting the dates. As such, we’ve included the following company costs in this report: 1. Compensation such as salary and wages, paycheck tips, and supplemental payments (e.g. bonuses and commissions payments), up to that $100cap 2. Severance payments 3. Contractor and vendor Pay 2. Expense reimbursements 3. Justworks admin fees 5. Workers’ Compensation fees 6. Fringe benefits and perks 7. See full list on help. However, there are also provisions in the interim final rule and application instructions that allow employers to use other date ranges, depending on if your business is seasonal or a new business. The alternative date ranges include: 1. We have included information in the report based on current regulations and the information that we have in our systems.

PPP Payroll Report : This automatically updated report , available to QuickBooks Online Payroll and QuickBooks Desktop Payroll users, pulls all eligible payroll expenses during the covered period. If you are a TriNet customer, please visit our COVID-Resources page. Small Business Administration, which administers the Payroll Protection Program ( PPP ), began accepting loan forgiveness applications Aug. The first accounting option is to report revenue and expenses in the same manner as the prior year while recording the PPP loan forgiveness as an extraordinary item. The second option is reporting revenue in the same manner as the prior year and reducing expenses for payroll , rent and utilities by the amount of funds attributed to the.

The Rhynhart report presents a number of findings that bolster the conclusion that the PPP was inefficient. Here are four takeaways from the report — all of which, in different ways, explain why. Remember that providing an accurate calculation of payroll costs is the responsibility of the borrower, so by completing the form, you are attesting to the accuracy of your calculations.

However, my business closed on March 16th a full month before i received any PPP funds. Can I apply for either the Familys First Benefit or the Payroll Tax Credit to cover any of the “uncovered” payroll prior to when my PPP loan was funded on APril 15th. An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis. PPP and Custom Reports in Square Payroll. Solved relevant to your payroll costs, you may need to man ually update the report.

Click Payroll Reports. Step 2: Enter the past months date range: i. If you use Payroll Protection Program ( PPP ) funds for unauthorized purposes, the SBA will direct you to repay those amounts. For borrowers with a biweekly (or more frequent) payroll schedule, the weeks (1days) beginning on the first day of the first pay period following the PPP loan disbursement. If you knowingly use the funds for unauthorized purposes, you will be subject to additional liability such as charges for fraud. PPP loans are available for the lesser of $million or 2. Find How Do You Do Payroll.

Get High Level of Information!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.