Get A Professional NDA Form In Mins. Create and Edit a Indemnity Agreement Form With Our Easy to Use Platform! An indemnity agreement also ensures proper compensation is available for such loss or damage. Indemnity can also refer to a legal exemption from loss or damages, as in the case of an indemnity clause in a contract, in which one party agrees to take the liability for loss or damage from another party.

In law, Contract of indemnity can be defined as a legal contract between two persons whereby one party commits to indemnify , i. A contract of indemnity, or hold harmless clause, establishes a method for transferring financial risk to a third party with a written contract. It lists all parties involve the situations covere and the party or parties that will shoulder the risk. An indemnity operates as a transfer of risks between the parties, and changes what they would otherwise be liable for or entitled to under a normal damage claim.

Business people enter into indemnity agreement samples with other parties to protect themselves against employee lawsuits or claims for damages to goods or vehicles. An Indemnity Agreement enables to transfer risk from one party to another easily. You can avoid liability issues before they happen with an Indemnity Agreement. In this arrangement, one party agrees to pay for potential losses or damages caused by another party. In a legal sense, it may also refer to an exemption from liability for damages.

The insurer promises to make the. Protect Your Business - Draft a Non Disclosure Agreement Now - Free Today. Non-Disclosure Agreement Examples. Fill Out Fields For Indemnity. Nevertheless, the contracts of insurance, i. Fire and Marine Insurance will be covered under the contract of indemnity , but life insurance is not covered in it.

The contract of indemnity is a form of contingent contract , as the liability of the indemnifier, is based on an event whose occurrence is contingent. An indemnity contract usually includes a contractual agreement between two parties where one party agrees to cover any losses or damages suffered by the other party. These contracts preclude board directors and company executives from personal liability, should the company be sued or suffer damages.

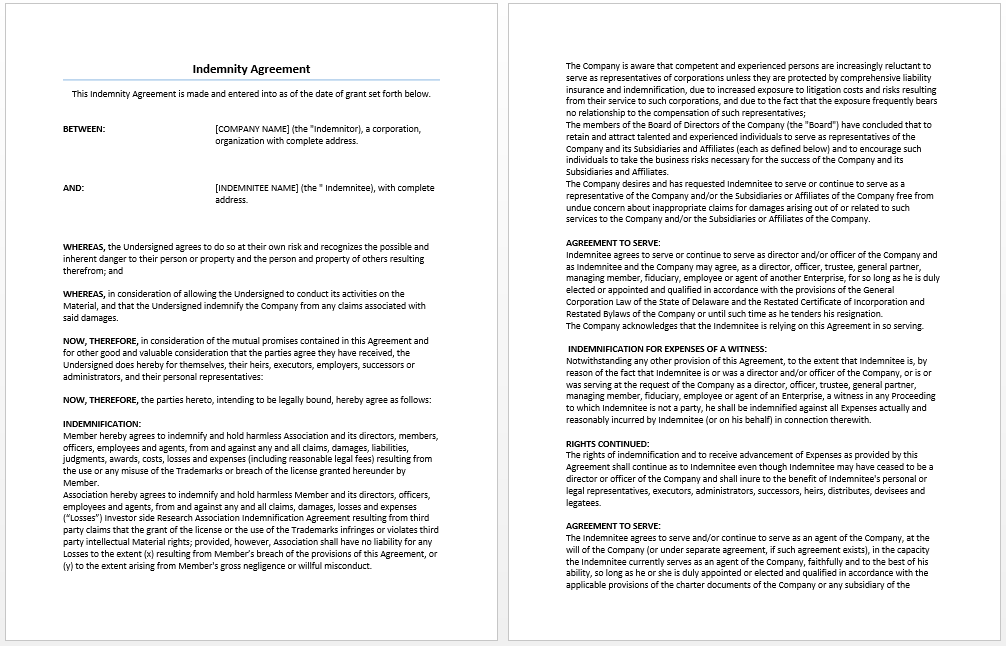

An insurance policy is an indemnity contract. Indemnity Contract — an agreement to pay on behalf of another party under specified circumstances. Companies often enter into an indemnity agreement with their officers or directors, under which the company agrees to indemnify the indemnitee against expenses and liabilities in connection with proceedings arising the acts or omissions of the indemnitee as an officer or director of the company.

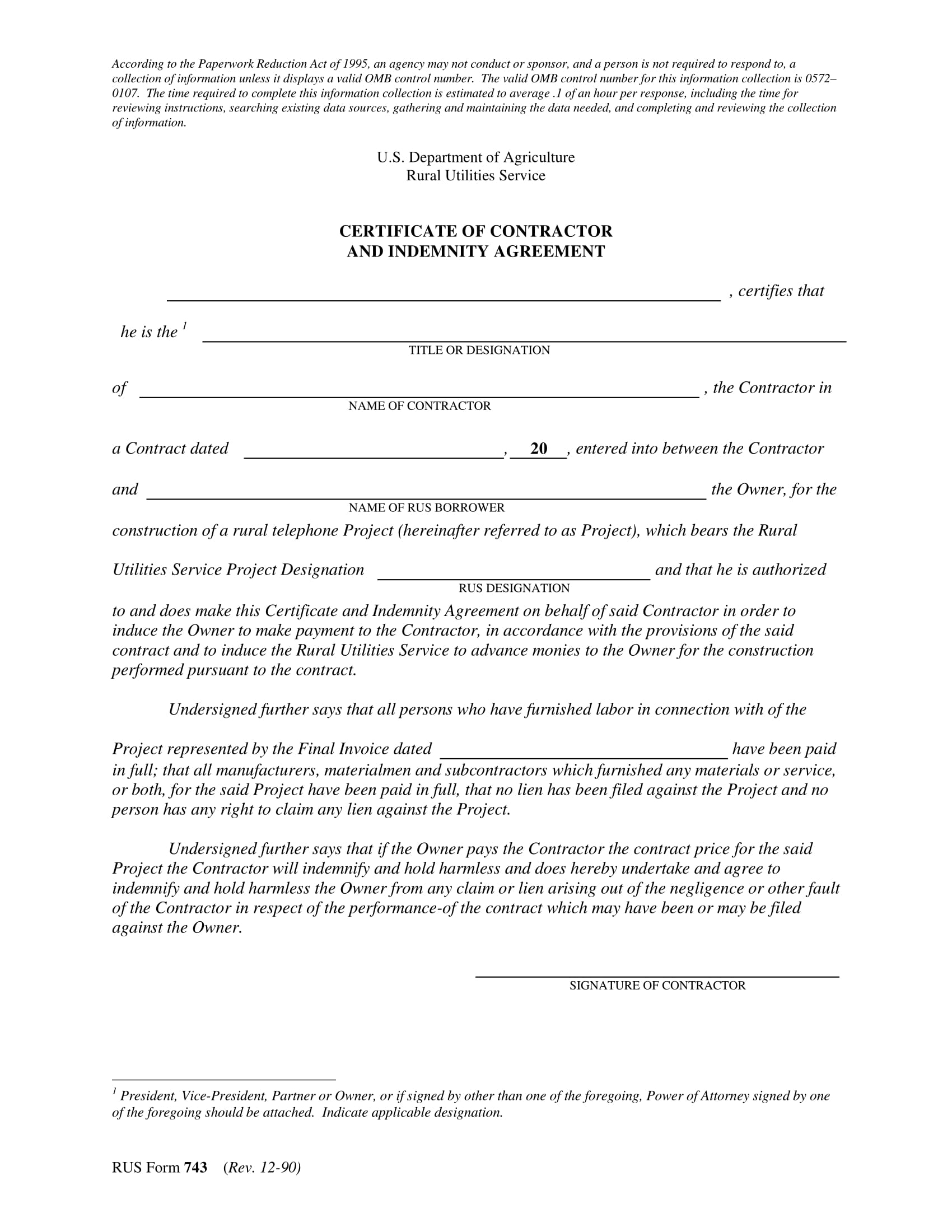

Sample Indemnity Agreement. More than just a template, our step-by-step interview process makes it easy to create an Indemnity Agreement. Save, sign, print, and download your document when you are done. Therefore, indemnity clauses are often the focus during contract negotiations. The meaning of indemnity clauses differs depending on individual situations and the contract itself.

In a one-way indemnification, only one party provides this indemnity in favor of the other party. The primary benefit of an indemnification provision is to protect the indemnified party against losses from third party claims related to the contract. Indemnification provisions are generally heavily negotiated (and often heavily litigated) clauses.

In other words, an indemnity is a contractual mechanism for allocating risk, in a similar way to a warranty in a typical MA contract , or a guarantee in a finance contract. Why are businesses keen on including indemnities in contracts ? This agreement contract form can be associated and used together with other documents such as business contracts , sale contracts. There are many different circumstances that can benefit from an Indemnity Agreement. Here are some of the most common usages: If a landlord allows a tenant to move in before the lease date (known as early occupancy), the landlord can use an Indemnity Agreement to ensure that the tenant is held to all the provisions of the lease, even though they are moving in early. Some of these ways relate to: Scope.

Indemnity clauses can often be drafted too broadly, seeking to protect against scenarios that are highly unlikely to occur. In contrast, the best kind of Indemnity Agreement is commonly called a Mutual Indemnity Agreement or a Mutual Hold Harmless Provision. These include insurance indemnity contracts , construction contracts , agency contracts , etc.

This is an obligation to indemnify that arises, not from a written agreement , but more from circumstances or the conduct of parties involved. One practical example is an agent-principal business relationship. An indemnity contract arises when one individual takes on the obligation to pay for any loss or damage that has been or might be incurred by another individual. The right to indemnity and the duty to indemnify ordinarily stem from a contractual agreement , which generally protects against liability, loss, or damage. Register and Subscribe now to work with legal documents online.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.