Form 9is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax. Use Form 9-V when making any payment with Form 941. However, if you pay an amount with Form 9that should’ve been deposite you may be subject to a penalty. See Deposit Penalties in section of Pub.

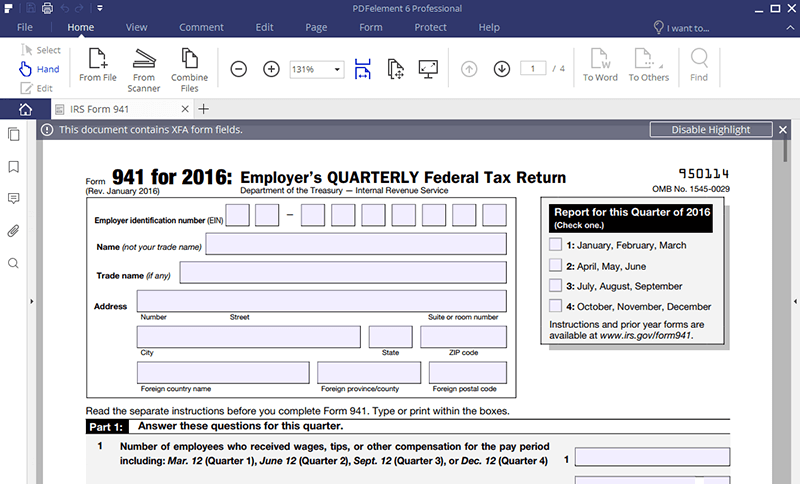

Specific Instructions Box 1—Employer identification number (EIN). For all the details on the mailing address for Form 9, head to the IRS website asap. Don’t forget that our website grants you the possibility to access the 9printable template, as well as fill out the form online with ease.

What do you need to complete Form 941? How to prepare Form 941? What is the purpose of IRS 9form? The IRS released two drafts of the 9instructions and released the final instructions on June 26.

The instructions are pages long. The prior version was pages. Part reports the employees, their wages, and the federal income taxes withheld from their paycheck. Part consists of lines where each line is explained in detail with the information that must be entered. See full list on taxbandits.

Part requires information about tax liability for the quarter, whether you are a semiweekly or monthly depositor. Line 1 you have options to check any one of the boxes based on your tax liability. You didn’t incur a $100next-day deposit obligation during the current quarter Check box If you were A monthly schedule depositorfor the entire quarter, and enter your tax liability for each month of the quarter (Month Month and Month 3). Your total liability for the quarter must be equal to line on your form 941. Check box If you were A semiweekly depositorduring any part of the quarter.

You must also enter the tax liability on Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it along the Form 9if you were a semiweekly depositor. Part will be mostly used by the businesses closed for the year or by the seasonal employer. Form 9and Form 9are very similar, since they both report FICA and income tax withholding. The main difference between the two forms is the amount of taxes owed by the company filing. Most small businesses file Form 9on a quarterly basis.

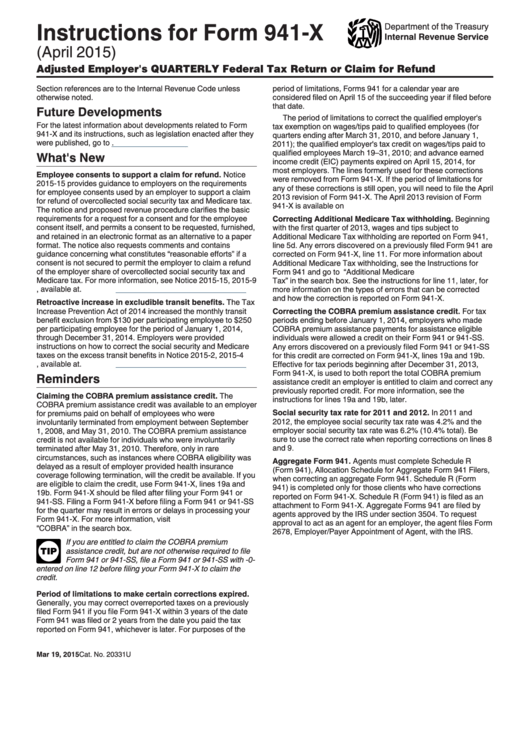

For additional details on filling out Form 9and sending it to the IRS, consult the IRS’s Instructions for Form 941. Patriot’s Basic Payroll customers will get a prefilled version of Form 9with all of the information we have available from them. Access IRS Tax Forms.

Search For Info About File form 9online. Complete, Edit or Print Tax Forms Instantly. TopProvides Comprehensive In form ation About Your Query. Updated on July 10:AM by Admin, TaxBandits. IRS Form 9- Line by Line Instructions - Explained.

If you are an employer, you likely need to fill out and file Form 9each quarter. It is based on what state your company is located. The Importance of Understanding Form 941. The goal of Form 9is to make sure that the amounts we show for liabilities ties out to our deposits, deferral and credits.

Each Form 9you file reports the total amount of tax you withheld during the quarter. Borrowers may also complete their application electronically through their Lender.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.