If your total FUTA tax after adjustments ( Form 9, line 12) is more than $50 you must make deposits by electronic funds transfer. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Virgin Islands (USVI) is the only credit reduction state. If you paid any wages that are subject to the unemployment compensation laws of the USVI, your credit against federal unemployment tax will be reduced based on the credit reduction rate for the USVI.

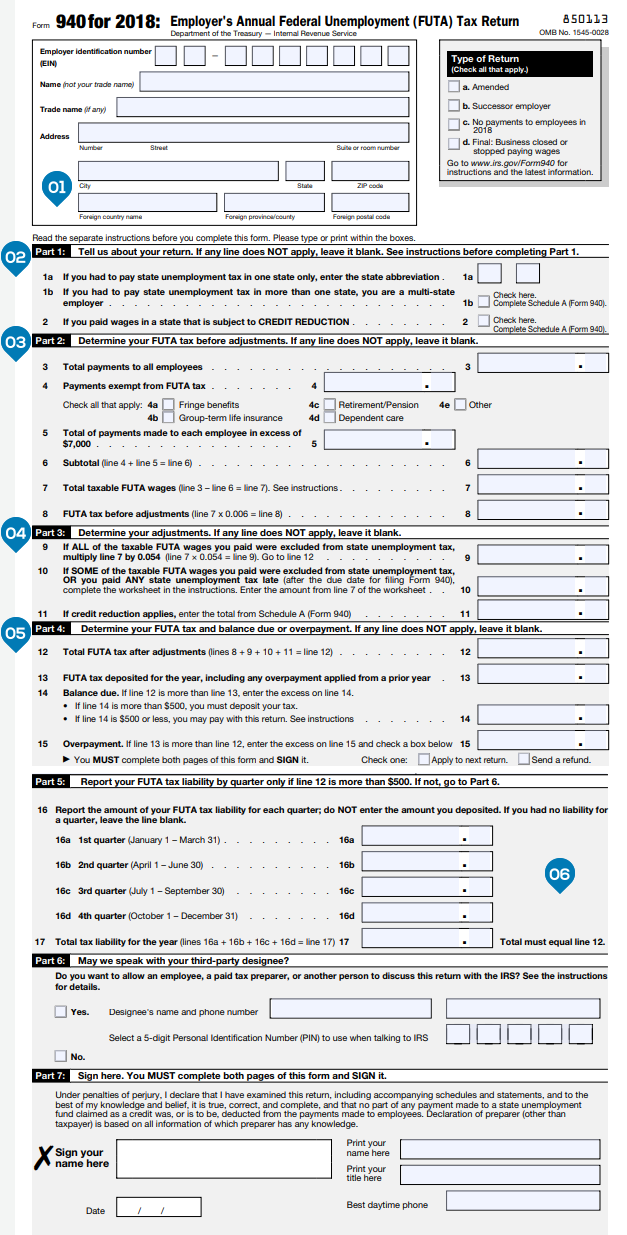

We ask for the information on Form 9to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes unemployment tax under the Federal Unemployment Tax Act. Form 9is used to determine the amount of the taxes that you owe. See Topic 7for more information about Form 940.

They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on Form 940. Employers must report and pay unemployment taxes to the IRS for their employees. Other articles from thebalancesmb. Enter your business name, address, and Employer Identification number (EIN).

What is Form 9used for? When do you have to make a 9deposit? Form 9, Employer’s Annual Federal Unemployment (FUTA) Tax Return, is a form employers file with the IRS to report their yearly FUTA tax liability. You must file a 9tax form if either of the following is true: You paid wages of at least $5to any employee during the standard calendar year. The standard FUTA tax rate is on the first $0of wages subject to FUTA tax.

The form is designed to help both small businesses and the IRS get on the same page about the Federal Unemployment (FUTA) tax owed. Searching Smarter with Us. Everything You Need To Know. Form 9covers a standard calendar year, and the form and payment are due annually by January for the prior year.

There may be earlier payment deadlines, however. If your FUTA tax liability exceeds $5for the calendar year, you have to make at least one quarterly payment. Certain types of businesses face special rules for filing Form 940. Individuals with household employees, such as nannies or maids, must pay FUTA taxes only if they paid $0or more in wages in any one calendar quarter. But instead of filing Form 9, you would file Schedule H along with your personal income tax return.

It’s based on the Federal Unemployment Tax Act (FUTA), a federal law that requires employers to pay taxes that cover unemployment payments for workers who lose their jobs. Form 9– or 9Form – is an IRS form that needs to be submitted annually. This form helps the employer calculate his or her FUTA taxes. While Form 9needs to be submitted once per year, your FUTA tax payments need to be paid every quarter. The maximum credit is allowed if all State Unemployment Tax (SUTA) was paid by the due date of Form 9, or if no State Unemployment Tax was due during the calendar year due to your State experience rate.

This FUTA rate is an Employer paid tax in the EasyACCT tax tables, and is calculated on the Payroll Journal. Additional Information about. You can open your tax form worksheet at the bottom of the report to determine the possible reasons. Then you can make necessary adjustments on the income subject to tax.

Let me know how it goes. The best way to file by IRS E-file. The form instructions for Form I-9require the applicant to report and submit information about whether the alien applied for, was certified or approved to receive, or received certain non-cash public benefits on or after Oct. See page of the form instructions.

Download Blank Forms , PDF Forms , Printable Forms , Fillable Forms.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.