What is a borrower certificate? Does Wells Fargo do home loans? Borrower ’s Certificate. The Undersigned certify the following: 1. Search For Online Certificate Now!

Find Online Certificate Today! Following the first round of funding, many questions arose about businesses that were approved that may or may not truly need the loan based on their access to other types of capital. All applicants were required to make a “good faith” certification that they were impacted by COVID-19.

In North America, a mortgage credit certificate , also called an MCC, is a document provided by the originating mortgage lender to the borrower that directly. Foundation Mortgage does not sell goods and services over the internet nor does it offer a digital loan process. This is a link to enter information only. Collateral, discount rates, certificates and other factors related to borrowing bases are different from bank to bank, so it’s wise to understand what yours expects.

I have applied for a Home Equity Line of Credit from Bank of America, N. Get High Level of Information! The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

Start a free trial now to save yourself time and money! As a result, having a basic understanding of the rights, benefits and risks of insurance certificates is important. For previous Multifamily Closing document versions, proceed here. CalHFA borrowers must complete homebuyer education counseling and obtain a certificate of completion through an eligible homebuyer counseling organization. See the definition of a first-time homebuyer.

No, this is not a requirement. Fillable borrower form. Obtain an operating statement for each real property owned. Only borrowers who meet all three criteria will be subject to recapture.

The borrower , another lender at the request of the borrower , the mortgagee or its successors and assigns, mortgage insurers, government sponsored enterprises, and other secondary market participants may rely on this appraisal report as part of any mortgage finance transaction that involves any one or more of these parties. The following are a list of questions and other considerations for borrowers , as it relates to their Economic Uncertainty certification for the PPP loan. This list is not meant to be all-inclusive.

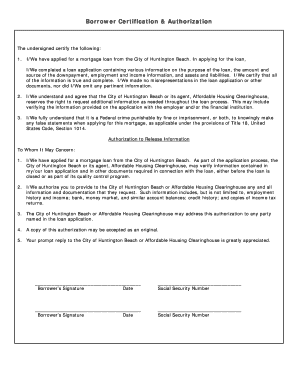

Other questions and considerations may be appropriate. If the borrower is purchasing in a targeted area than the borrower ’s household income for the MCC may not exceed 1 (1 for families of less than three) of the greater of the applicable median gross income. Under the Mortgage Credit Certificate Program, certificates will be issued to eligible borrowers on a first come, first serve basis. The Certification and Authorization form is a document that you’re required to sign to certify that all the information you provided during the application process is true and complete.

The information on the form refers to the purpose of the loan, the amount and source of the down payment , employment and income information, and assets and. BORROWER CERTIFICATION FORM. With DCHFA’s Mortgage Credit Certificate (MCC), qualified borrowers have the ability to claim a Federal Tax Credit of of the mortgage interest paid during each calendar year.

To get started with an MCC, please contact one of our participating lenders. The COE verifies to the lender that you are eligible for a VA-backed loan. This page describes the evidence you submit to verify your eligibility for a VA home loan and how to submit the evidence and obtain a COE. The required certification was in place before.

Simply put, mortgage lenders are requiring more paperwork from borrowers today than they did in the past. TopProvides Comprehensive Information About Your Query.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.