Get Trusted Legal Forms. Sample Loan Agreements - Start Now. Free Loan Agreement Template In Your Browser. Download A Loan Agreement In Minutes. Using a Loan Agreement.

An individual or business can use a loan agreement to set out terms such as an amortization table detailing interest (if any) or by detailing the monthly payment on a loan. The greatest aspect of a loan is that it can be customized as you see fit by being highly detailed or just a simple note. Short: A loan agreementis a legal binding formal document that constitutes both positive and negativecovenants between the borrower and the lender to protect both parties in caseeither party fails to honor their pledges. Detailed: A loan agreement is a written document that gives the terms and conditions thatsurround borrowing and repayment of money.

The agreement spells out clear. A loancontract: This is when other parties including the employer if the borroweris involved in paying the loan. The contract lasts for a specified period oftime. Promise to Payor Promissory Note. This comes up in cases of personal loans where family,friends and acquaintances are involved.

Secured Note: Secured note for loans that have guarant. People borrow money for various reasons, indifferent conditions and from different types of people or institutions aswell. See full list on wordtemplatesonline. For these reasons, to satisfy the needs of the different types ofborrowers, there exists different types of loan agreements.

Onemight wonder why people should sign forms in such cases, yet this is a familymatter. There are families that are purely legal and official in everythi. Here aresome of the reasons why loan agreements are written.

Borrowing money from or lending to family andacquaintances requires agreements to avoid bridging of trust. Borrowing from or lending money to companies orbusinesses requires an agreement for legal purposes and clarity of theconditions in case of changes in management , changes in business plans amongother reaso. A loan agreement is made up of the followingcomponents:Detailedcontact information _The details of the borrower, thelender, the guarantors if any, referees and witnesses are required here. Theinformation on their official names, nationalities, physical postal addresses,gender, age and dependents are given. This is important for location and followup when need arises.

Acceleration _These are details which gives the lender protection from defaulting. Here thedetails of the payment mode, the inte. It is not a sign of mistrust in manycircumstances but at the same time being safe is better than being sorry.

Loan agreements serves many purposes ranging fromtrust to formality and legal requirements. Theseagreements benefit both the borrower and the lender. Without a clear method ofpaying back, the loans might be defaulte or the lender may take advantage ofthe borrower and have all their assets confiscated. Several reasons could propel you toseek a loan agreement of which all will be associated with either borrowing orfully paying a loan.

Here are some detailed ideas on why you would require aloan agreement. Car Loan– A loan agreement is vital when borrowing to. Helping people close to someone feels good since itis a moral responsibility. Charging interest on friends, colleagues or familymembers might be hard but at the same time, money stays intact when constantlygrown. One way of growing money is through lending at an interest.

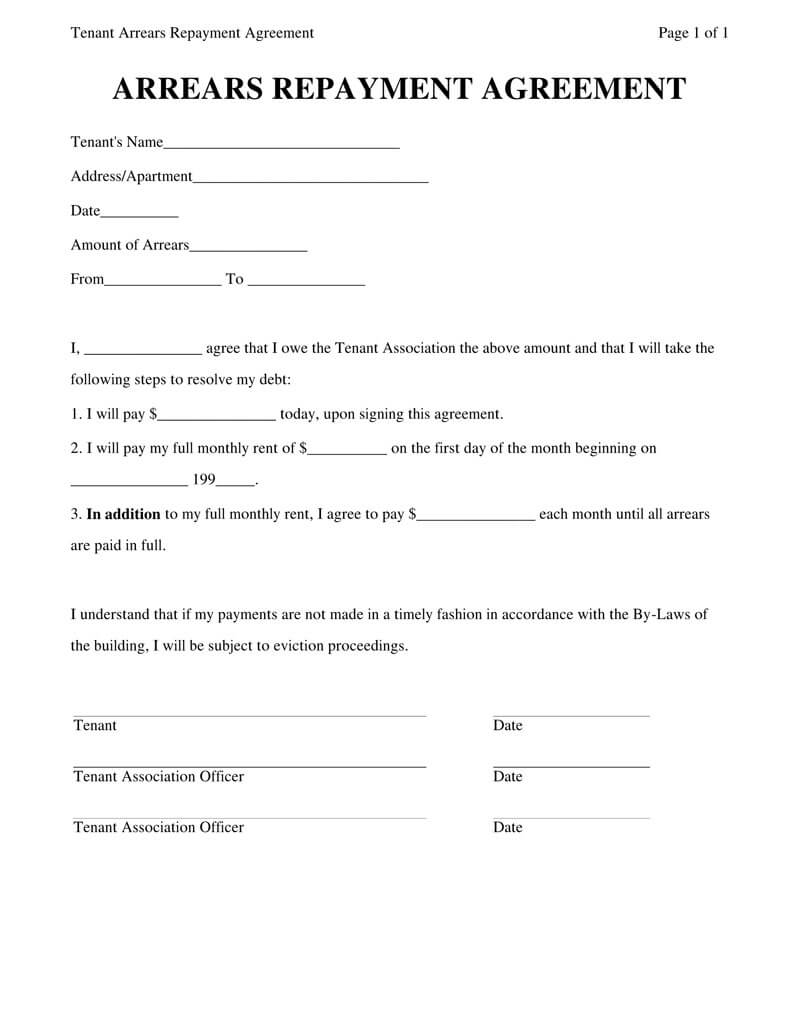

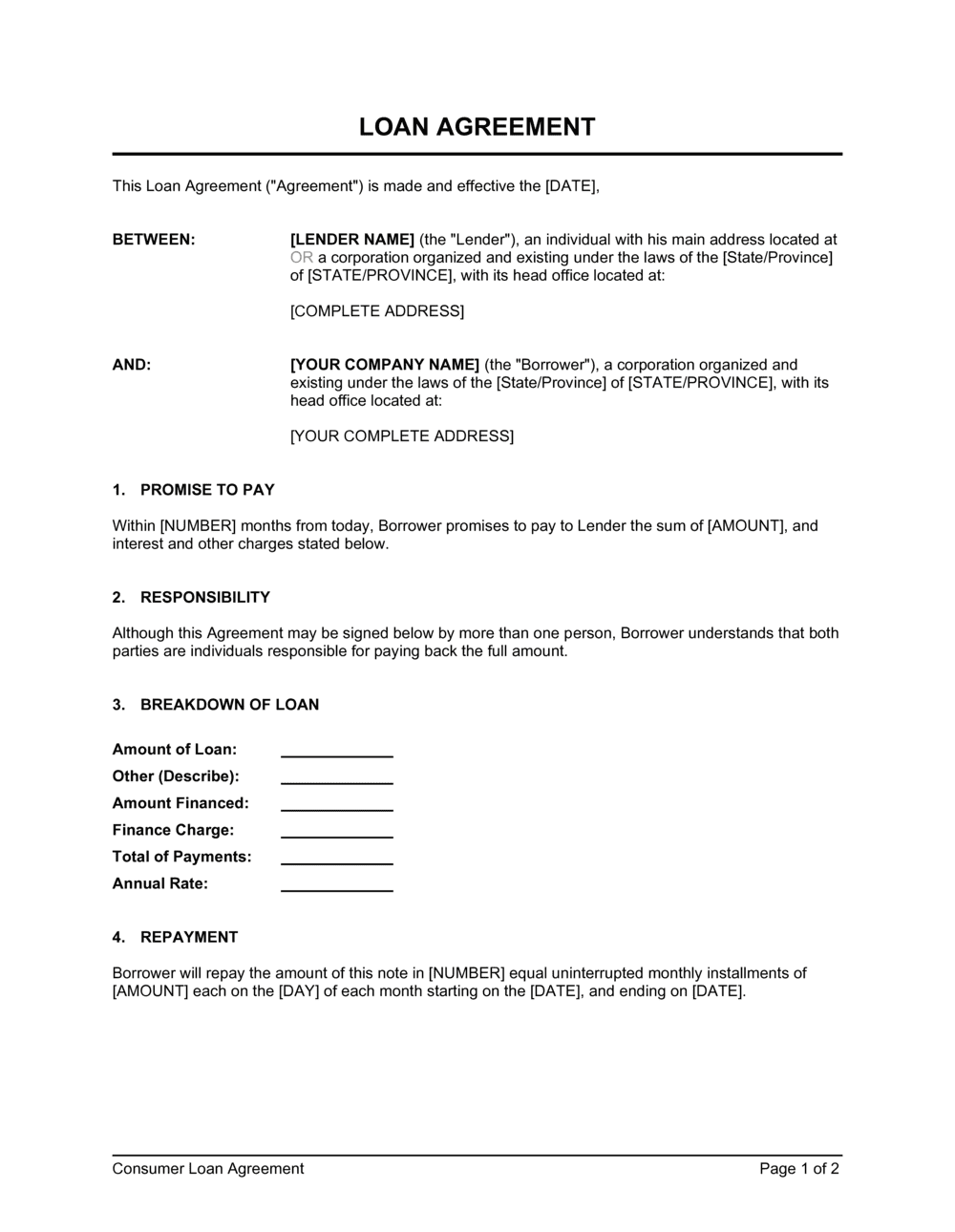

Of at all, ifyou want to continue helping, then interest will be important. In doing so youshould consider looking at the stipulated laws governing interests to avoidpain and conflict. Loan Agreement should include the terms about the rights of borrower on his property and what will happen to the property if the borrower fails to return the loan in time. This is a sample of a loan agreement form and gives the user an idea of the format to be followed and the subheadings to be included when designing such a form.

You may also see Rental Agreement Forms. The personal loan agreement consists of the date when the loan was borrowe the loan payment date as agree the amount involve signatures for both parties, the interest rate , and any other relevant information about the loan. This kind of loan is legally binding to protect either of the two parties in case of future disagreements. A personal loan agreement template is a document that anyone can use to protect themselves as a lender.

Filling out a simple loan agreement ensures that there is no confusion between the lender and the person in need of funds. A loan contract template takes the difficulty out of designing a concise and precise document. How do I create a loan agreement?

What to inlcude in a loan agreement? When to sign loan agreement? This loan agreement can be used for any situation that requires a loan to be paid back over a specific amount of time. Comprehensive For Immediate Use.

It includes loan terms, payment schedule, and more. A standard loan agreement template would include the contact information about the lender and the borrower. It would include how the loan would be repaid and would highlight the option, which is agreed upon for the loan repayment. Its primary function is to serve as written evidence of the amount of a debt and the terms under which it will be repai including the rate of interest (if any).

TidyForm provides a large number of free and hand-picked Simple Loan Agreement Template, which can be used for small, medium and large-sized enterprises. You can find practical, colorful files in Wor Excel, PowerPoint and PDF formats. The schedule also includes how often the money will be repai in what amount and when the payment is due (e.g. $2to be paid on the 1st of each month).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.