If you don’t have one, you can create a myGov account. You can use these services to report on public holidays. Most people need to report every days. We call this your reporting period.

We’ll tell you when your reporting period starts and ends. You must report your and your partner’s gross income for the most recent reporting period. Hi all I have a question about dividends. I am confused however as to whether I report the dividends to them.

I receive dividends per year which usually equate to $9and am concerned for my payment. Any help would be much. This will mean that reporting and payment days may change.

Report it even if your employer hasn’t paid you yet I reported to the decimal my estimated income, based on the days I had worked. Stay up-to- date on the coronavirus outbreak. If you need help: using your myGov account go to my.

The July start date hinges on the draft legislation passing by mid-May otherwise it could be set back. Get InDaily in your inbox. I can see that I was supposed to report yesterday (on the 21st), now my next reporting date is on the 4th of next month. From 21st to 4th is days, not as the fortnightly period. If I had reported on the 21st, would the reporting date be the 3rd?

Some payments will be made earlier and reporting dates may have changed. We would have also sent you a reminder. Changes to reporting dates do not affect the assessment perio and earnings estimates will still need to be reported for your normal 14-day perio” he explained. Centrelink office closures.

People still need to report estimates of earnings and other changes for their normal day. While reporting dates may be different, the assessment period remains the same. I will definitely ask them to change my reporting date though to make it easier thanks so much for the advice.

Lodgment and payment dates on weekends or public holidays. The lodgment program adopts standard due dates that may fall on a weekend or public holiday. When a due date for lodgment of an approved form or payment of a tax debt falls on a day that is not a business day, you can lodge or pay on the next business day.

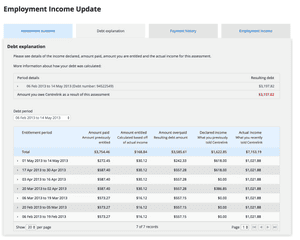

The amount earned in the reporting period may be different, after deductions, to the amount received and to complicate matters, the dates on payslips may not match the reporting period. The income can be estimate by using how many hours you work. If there is major differences, you can ring up and change income report.

These dates indicate the end of the reporting period. A reporting period always begins the day after the closing date of the last report filed. If the committee is new and has not previously filed a report , the first report must cover all activity that occurred before the committee registered up through the close of books for the first. Yes, income must be reported as normal.

Reporting income should not be confused with the currently suspended Mutual Obligations. Do I need to report the $7Economic Support payments when doing my normal fortnightly income report ? Check out the Markets Insider earnings calendar. See who is reporting this week. Find earnings report and search by company, date and market cap.

They will have a fresh look at the decision and call you to discuss it. Payments and details you need to report. The basic details you need to record about each of your payees are the same for everyone, but the payments you need to report on your Taxable payments annual report (TPAR) depend on whether you are a business or a government entity.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.