The tax -free threshold is the amount of income you can earn each financial year that is not taxed. By claiming the threshol you reduce the amount of tax that is withheld from your pay during the year. Australian taxation law notes.

LLB Law Third 3rd Year PDF Notes, Books,. LLB - Law third year notes, eBooks, handouts and. Taxation Law notes required for LLB course? The ATO is the Government’s principal revenue collection agency.

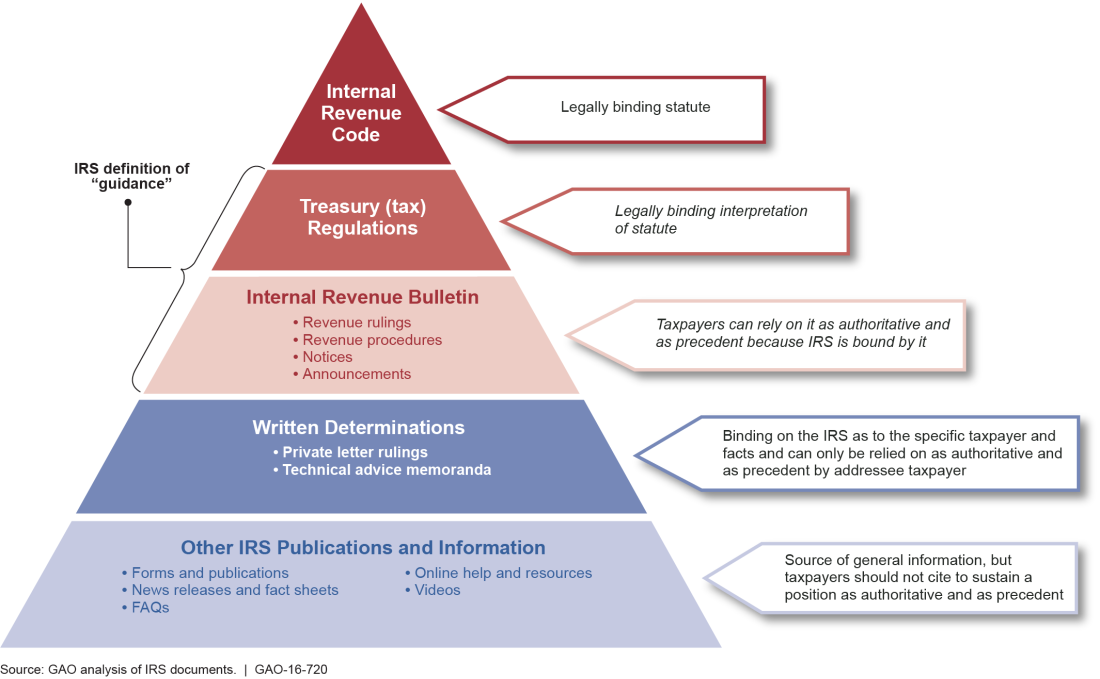

If you have problems opening the pdf document or viewing pages, download the latest version of Adobe Acrobat Reader. BFA 7at University of Tasmania. It provides a conceptual. The design of these tax systems was largely driven by administrative concerns, rather than principles of equity or efficiency. The Rule of Law and Contract Law The rule of law ( see the Rule of Law Pyramid below) provides stability and predictability in the legal system.

For contracts to be binding and enforceable a society needs a stable civil law system. G Tony Pagone will deliver his inaugural Patron’s address. They are discussed in more detail throughout the publication. Standard mileage rate. Guides to Legislation do not have the force of law.

Certified Public Accountants (CPA) Download Revised Edition of KASNEB CPA notes for Section Section Section Section Section and 6. These are updated CPA notes in pdf format, free past papers also provided. Below are the Read More. Sell your copy of this.

Be introduced to the fundamental common law principles and statutory provisions of assessable income and allowable deductions in relation to personal income and business affairs. Analyse at length capital gains tax and fringe benefits tax. Low-Income Tax Offset.

The Low Income Tax Offset (LITO) is a tax rebate for individuals on lower incomes. This year’s edition comprises 1jurisdictions. If the child tax credit exceeds taxes owe up to $4of the child tax credit can be refundable for each qualifying child.

The subject aims to provide lawyers with a sound understanding of the principles of taxation in relation to income tax. We’re a network of firms in 1countries with more than 230people who are committed to delivering quality in assurance, advisory and tax services. From establishing the appropriate business vehicle, financing a corporate subsidiary and adhering to the requisite transfer pricing regulations to computing corporate. Therefore, tax administration should have in place strategies and structures to ensure that non-compliance with tax law is kept to a minimum. Collection of tax by distraint.

Power to collect tax from person owing money to the taxable person. Appointment of tax withholding agents. Preservation of funds. Tax payable to Commissioner. Security on property for unpaid tax.

Tax to be recovered as civil debt. Tax Laws and Practice Company Law. A Bill for an Act to amend the law in relation to. With the old tax laws , your 5could only be used at eligible colleges and universities.

Under the new laws , you can use your plan to cover up to $10per year of qualifying expenses for any school (public, private, or religious) and any grade from kindergarten through 12th as well. A bill to make technical corrections to the computation of average pay under Public Law 110. Baker Tilly US, LLP (Baker Tilly) is a leading advisory, tax and assurance firm whose specialized professionals guide clients through an ever-changing business worl helping them win now and anticipate tomorrow.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.