What is an indemnity clause in a lease? Indemnification by Loan Parties. Many business ventures require a high capital input to generate large amounts of revenue.

Securing a loan can provide a business the leverage it needs to turn a large profit. Due to the potential risk of disability, numerous institutions are hesitant to provide large loans to individuals in fear the loan will not be paid back. Apartment Trust of America, Inc. This insurance protects the holder from having to pay the full sum of an indemnity, even if. In the event of any conflict, ambiguity or inconsistency between the terms of this Loan Agreement and the Security, the terms of this Loan Agreement shall govern and prevail to the extent necessary to remove the conflict, ambiguity or inconsistency.

Such an event may be disability or illness, unemployment,. All VA requirements for servicing and payment of loan fees will be observed in respect to such mortgage. Find Loans Available. Making Your Search Easier.

TopProvides Comprehensive Information About Your Query. SearchStartNow Provides Comprehensive Information About Your Query. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

In a one-way indemnification , only one party provides this indemnity in favor of the other party. The primary benefit of an indemnification provision is to protect the indemnified party against losses from third party claims related to the contract. Business Loan Failure to Survive.

This unique insurance protection was designed to indemnify a lender for the balance of money at risk given a contractual business loan agreement. A premature death or disablement of the borrower will usually trigger an immediate call on the loan. The Court explained that the claims were governed by New York law, which actually borrowed the law of Delaware in these circumstances.

Whether the need is due to disability or unemployment, this insurance can help cover. One common example of indemnity insurance is malpractice insurance, which is a form of coverage for medical professionals, and errors and omissions insurance, which covers. The tightening of credit and underwriting standards in recent years has led to the increased scrutiny of purchased loans by investors, and the willingness to demand buy-backs or indemnification at the slightest hint of red flags. AMLG built up its experience in dealing with mortgage loan repurchase demands long before the crisis began. They are widely used by many types of industries to protect their businesses.

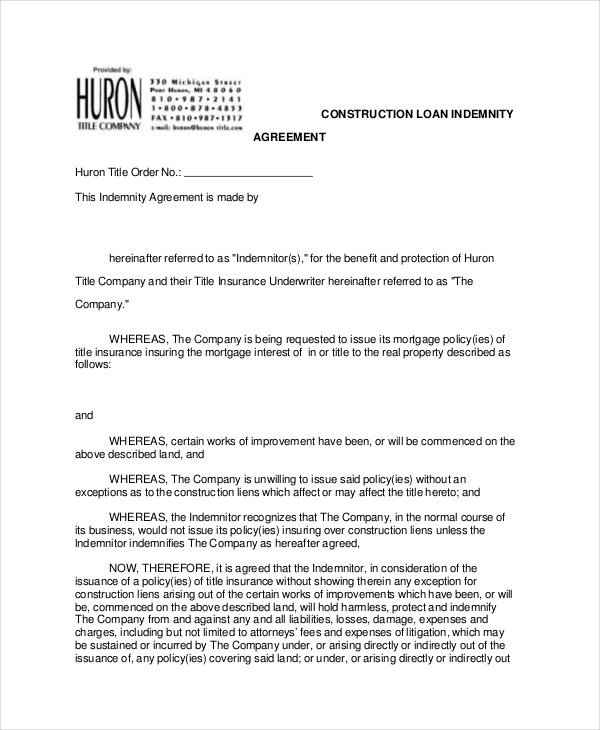

One can go through various templates that are available on the internet and select the suitable format for their business requirements. Lender” agrees to indemnify VA for losses, which have or may be incurred on the following loans , if the loans or subsequent VA interest rate reduction refinancing loans go into default, as defined in C. Register and Subscribe now to work with legal documents online. Guarantees and indemnities are a common way in which creditors protect themselves from the risk of debt default.

However, this month we are taking a slightly different approach. A loan agreement will generally contain an indemnity clause. An indemnity is an obligation by one person (the indemnitor) to provide compensation for a particular loss suffered by another person (the indemnitee). By offering indemnification and assuming some portion of the risk in a securities loan , the agent takes on an off-balance sheet liability that must be funded in order to keep the ratio at or above required minimums. The types of indemnity contract include protection or security from a financial liability.

An indemnity contract usually includes a contractual agreement between two parties where one party agrees to cover any losses or damages suffered by the other party. Limited 203(k) Mortgage. The process of shifting a loss from one party to another either because of an express agreement by the parties or because the law requires it under the circumstances. Mortgage indemnity insurance is a product from AmTrust that protects lenders in the event that a borrower defaults on their mortgage and the property is then sold at a loss. Learn how our customisable mortgage insurance works.

The loan level include all loans where the lender executed an indemnification agreement, irrespective of the status of the loan (e.g. terminate paid-in-full, streamline refinance etc.) or the status of the indemnification agreement (active or expired).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.