Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Don’t forget that our website grants you the possibility to access the 9printable template, as well as fill out the form online with ease. You are a semiweekly depositor if you: Reported more than $50of employment taxes in the lookback period.

Accumulated a tax liability of $100or more on any given day in the current or prior calendar year. See full list on apps. Register and subscribe day free trial to work on your state specific tax forms online. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

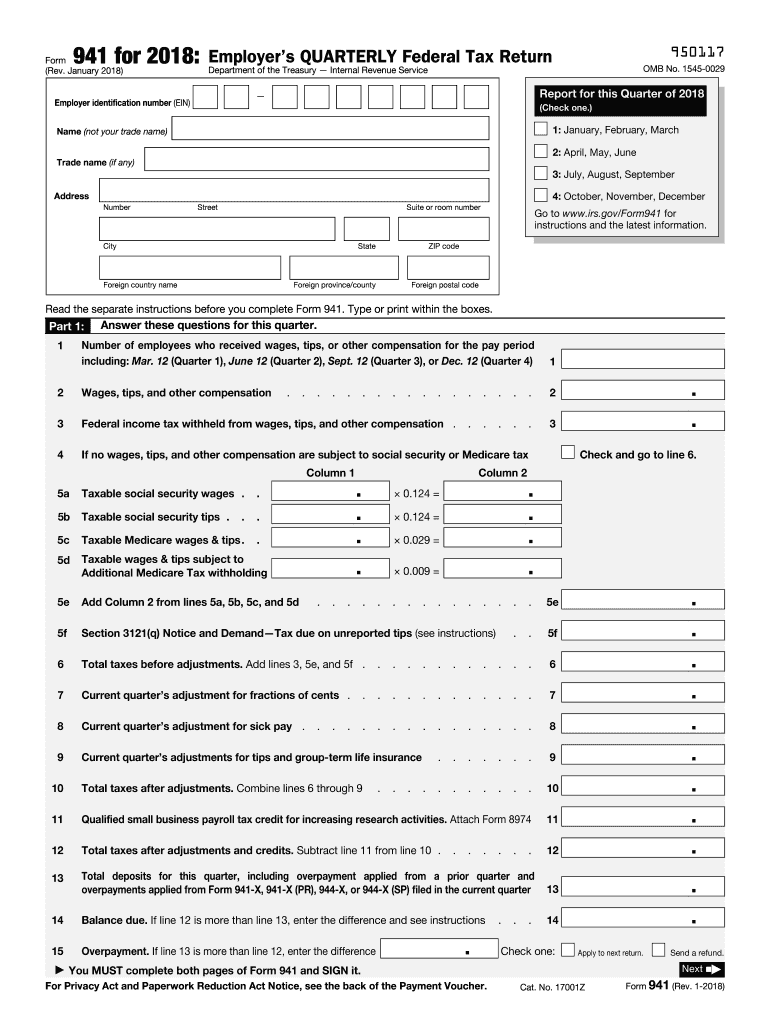

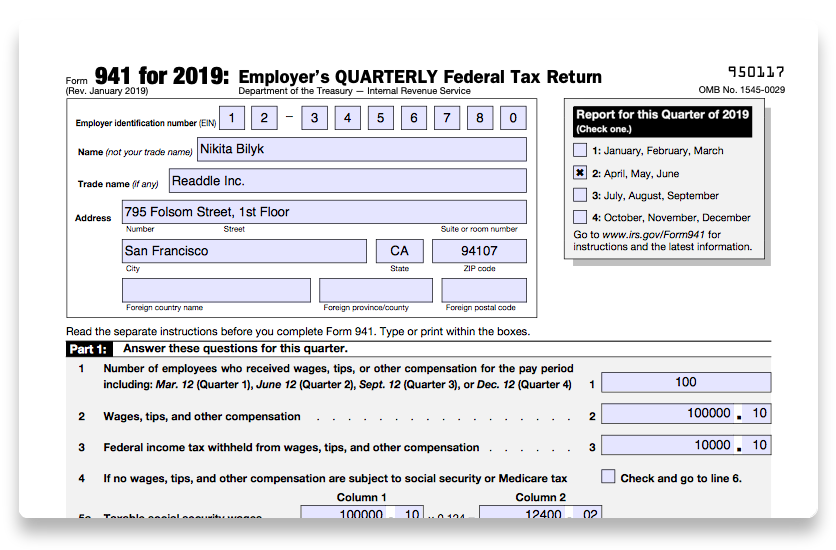

Available for PC, iOS and Android. Start a free trial now to save yourself time and money! The penalty caps out at percent. A separate penalty applies for making tax payments late or paying less than you owe. Department of the Treasury — Internal Revenue Service.

Search For Info About Tax return free. Form 9(PR) (Schedule A). Powerful and Easy to Use. Take control of IRS payroll tax penalties and interest and prepare IRS Forms.

This form is available electronically. There are a number of good software programs that can streamline the process. The webinar instructor will specify filing requirements and offer tips on reconciling and balancing the two forms. You must make monthly or semi-weekly deposits of payroll taxes collected. Or if you are a freelancer that receives a salary from your company of one, then you are required to submit a form 9to the IRS four times a year.

Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Fill Out Forms In Our Builder. The main difference between the two forms is the amount of taxes owed by the company filing.

The 3rd quarter deadline to e-file 9was on October 31st. Virgin Islands OMB No. Note : Only semi-weekly depositors are required to file form Schedule B, when any other deposit frequency is selected a Schedule B will not be e-filed and you will likely receive a tax notice.

This specific form is generally due on the last day of the month following the end of the period. I had already successfully accessed that same form at IRS. Then, you can follow these steps: Go to the Reports menu.

Under Which worksheet do you want to create? What we can do is download a form from the IRS and manually enter the information on it. We can reach out to the IRS by contacting them or visiting their website. Trust or Estate – the adjusted gross income is the total income and charitable contributions reported to IRS.

Business Equipment Tax Reimbursement (BETR) Employment Tax Increment Financing (ETIF) Note: This link is offsite. Pine Tree Development (PTDZ) Program Additional Tax Relief.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.