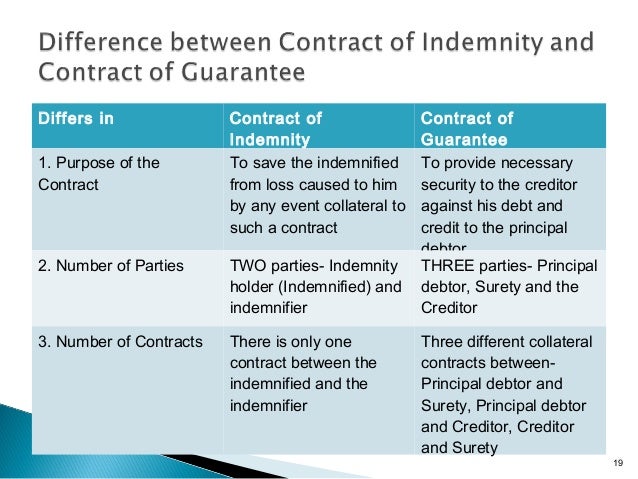

What is essential for contract of indemnity? Are You guaranteeing an indemnity? In contract of guarantee there are three parties i. A contract of guarantee involves three parties i. An indemnity is for reimbursement of a loss , while a guarantee is for security of the creditor. In a contract of indemnity the liability of the indemnifier is primary and arises when the contingent event occurs. The object of contract of guarantee is the security of the creditor.

The contract of indemnity is made to protect the promise against some likely loss. Simply put, indemnity implies protection against loss , in terms of money to be paid for the loss. Indemnity is when one party promises to compensate for the loss that occurred to the other party, due to the act of the promisor or any other party. There are two parties in this form of contract. Contract of Indemnity.

But guarantee contract includes three parties namely creditor, Principal debtor, and surety. While a contract of guarantee has parties, with varying liabilities, a contract of indemnity has two parties with primary liability. Firstly, there are just two parties in indemnity , while there are three in contracts of guarantee. Our AI Software Writes Your Indemnity Agreement. Comprehensive - Immediate Use.

Online - Takes Less Than Minutes. But in contract of indemnity , indemnifier is a primary one. This contract depends upon happening a loss. It may be oral or expressed. Now, John can recover the compensation from Peter.

This is an implied form of a contract of indemnity. Beta Insurance Company entered into a contract with Alpha Ltd. It is merely a security to Creditor. Under the contract of indemnity the claimant can recover all the loss if there is a breach of a contract. Under it, if there is a breach of warranty then the warrantor has to bear all the damages.

In guarantee , if surety makes payment to creditor, surety can recover that amount from principal debtor. Surety provides guarantee only when requested by the principal debtor in a contract of guarantee. Indemnifier is not required to act at the request of the debtor, in a contract of indemnity. In a contract of guarantee , there is an existing liability for debt or duty, surety guarantees the performance of such liability. GUARANTEE Definition: SEC.

Get High Level of Information! Guarantee for credit sales 6. The three parties are: Surety: The one who gives. Build Custom Release Forms For any Purpose - Organize Important Forms Today!

Indemnity ’ is a widespread expression used not only in a contractual context. Basically, indemnity infers security against misfortune, as far as cash to be paid for misfortune. Indemnity is the point at which one gathering guarantees to remunerate the misfortune jumped out at the other party, because of the demonstration of. These contracts might appear similar to indemnity contracts but there are some differences between them.

In guarantee contracts , one party contracts to perform a promise or discharge a liability of a third party. A person to obtain an employment, or a loan, or some goods or service on credit. Similarly, the doctrine of Subrogation has been introduced to carry out the fundamental rule that of indemnity.

None of above View Answer Workspace Report Discuss in Forum. A guaranfee which extend to. Fill Out Fields For Indemnity. Get Approved Legal Docs - 1 Free!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.